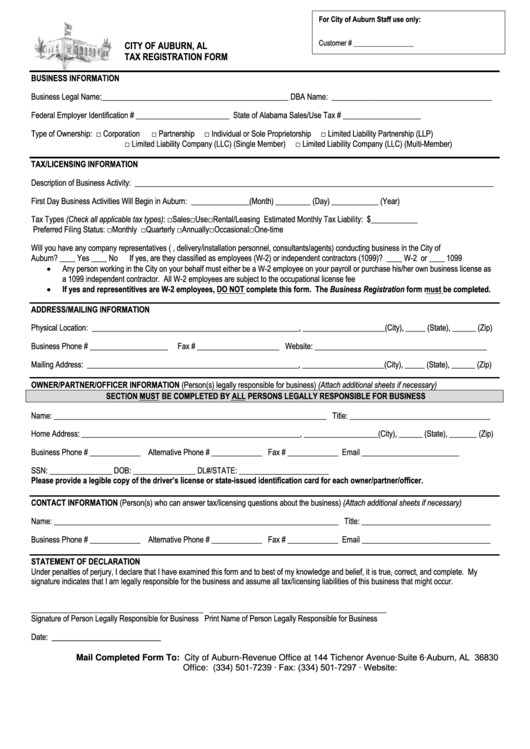

Tax Registration Form - City Of Auburn, Alabama

ADVERTISEMENT

For City of Auburn Staff use only:

Customer # _________________

CITY OF AUBURN, AL

TAX REGISTRATION FORM

BUSINESS INFORMATION

Business Legal Name:________________________________________________ DBA Name: _________________________________________

Federal Employer Identification # ________________________

State of Alabama Sales/Use Tax # ____________________

Type of Ownership:

□ Corporation

□ Partnership

□ Individual or Sole Proprietorship

□ Limited Liability Partnership (LLP)

□ Limited Liability Company (LLC) (Single Member)

□ Limited Liability Company (LLC) (Multi-Member)

TAX/LICENSING INFORMATION

Description of Business Activity: ____________________________________________________________________________________________

First Day Business Activities Will Begin in Auburn: _______________(Month) _________ (Day) ____________ (Year)

Tax Types (Check all applicable tax types):

□Sales

□Use

□Rental/Leasing

Estimated Monthly Tax Liability: $____________

Preferred Filing Status:

□Monthly

□Quarterly

□Annually

□Occasional

□One-time

Will you have any company representatives (i.e. salespersons, delivery/installation personnel, consultants/agents) conducting business in the City of

Auburn? ____ Yes ____ No

If yes, are they classified as employees (W-2) or independent contractors (1099)? ____ W-2 or ____ 1099

Any person working in the City on your behalf must either be a W-2 employee on your payroll or purchase his/her own business license as

a 1099 independent contractor. All W-2 employees are subject to the occupational license fee

If yes and representitives are W-2 employees, DO NOT complete this form. The Business Registration form must be completed.

ADDRESS/MAILING INFORMATION

Physical Location: _____________________________________________________, _____________________(City), _____ (State), ______ (Zip)

Business Phone # ____________________

Fax # _____________________ Website: ____________________________________________

Mailing Address: ______________________________________________________, _____________________(City), _____ (State), ______ (Zip)

OWNER/PARTNER/OFFICER INFORMATION (Person(s) legally responsible for business) (Attach additional sheets if necessary)

SECTION MUST BE COMPLETED BY ALL PERSONS LEGALLY RESPONSIBLE FOR BUSINESS

Name: ______________________________________________________________________ Title: ____________________________________

Home Address: ________________________________________________________, ___________________(City), ______ (State), _______ (Zip)

Business Phone # _____________ Alternative Phone # _____________ Fax # _____________ Email _________________________

SSN: ________________

DOB: ________________

DL#/STATE: _______________________

Please provide a legible copy of the driver’s license or state-issued identification card for each owner/partner/officer.

CONTACT INFORMATION (Person(s) who can answer tax/licensing questions about the business) (Attach additional sheets if necessary)

Name: _________________________________________________________________________ Title: _________________________________

Business Phone # _____________ Alternative Phone # _____________ Fax # _____________ Email _________________________________

STATEMENT OF DECLARATION

Under penalties of perjury, I declare that I have examined this form and to best of my knowledge and belief, it is true, correct, and complete. My

signature indicates that I am legally responsible for the business and assume all tax/licensing liabilities of this business that might occur.

_______________________________________

________________________________________

Signature of Person Legally Responsible for Business

Print Name of Person Legally Responsible for Business

Date: ____________________________

Mail Completed Form To: City of Auburn-Revenue Office at 144 Tichenor Avenue∙Suite 6∙Auburn, AL 36830

Office: (334) 501-7239 ∙ Fax: (334) 501-7297 ∙ Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1