Save

Reset

Print

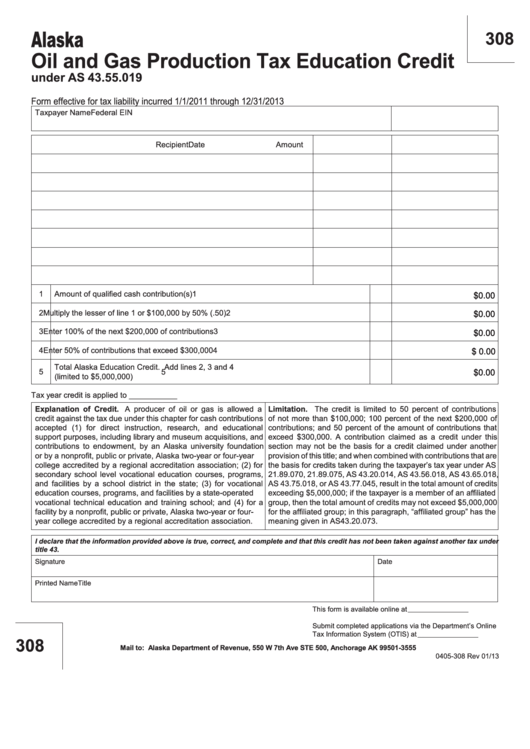

Alaska

308

Oil and Gas Production Tax Education Credit

under AS 43.55.019

Form effective for tax liability incurred 1/1/2011 through 12/31/2013

Taxpayer Name

Federal EIN

Recipient

Date

Amount

1

Amount of qualified cash contribution(s)

1

$0.00

2

Multiply the lesser of line 1 or $100,000 by 50% (.50)

2

$0.00

3

Enter 100% of the next $200,000 of contributions

3

$0.00

4

Enter 50% of contributions that exceed $300,000

4

$ 0.00

Total Alaska Education Credit. Add lines 2, 3 and 4

5

5

$0.00

(limited to $5,000,000)

Tax year credit is applied to ___________

Explanation of Credit. A producer of oil or gas is allowed a

Limitation. The credit is limited to 50 percent of contributions

credit against the tax due under this chapter for cash contributions

of not more than $100,000; 100 percent of the next $200,000 of

accepted (1) for direct instruction, research, and educational

contributions; and 50 percent of the amount of contributions that

support purposes, including library and museum acquisitions, and

exceed $300,000. A contribution claimed as a credit under this

contributions to endowment, by an Alaska university foundation

section may not be the basis for a credit claimed under another

or by a nonprofit, public or private, Alaska two-year or four-year

provision of this title; and when combined with contributions that are

college accredited by a regional accreditation association; (2) for

the basis for credits taken during the taxpayer’s tax year under AS

secondary school level vocational education courses, programs,

21.89.070, 21.89.075, AS 43.20.014, AS 43.56.018, AS 43.65.018,

and facilities by a school district in the state; (3) for vocational

AS 43.75.018, or AS 43.77.045, result in the total amount of credits

education courses, programs, and facilities by a state-operated

exceeding $5,000,000; if the taxpayer is a member of an affiliated

vocational technical education and training school; and (4) for a

group, then the total amount of credits may not exceed $5,000,000

facility by a nonprofit, public or private, Alaska two-year or four-

for the affiliated group; in this paragraph, “affiliated group” has the

year college accredited by a regional accreditation association.

meaning given in AS 43.20.073.

I declare that the information provided above is true, correct, and complete and that this credit has not been taken against another tax under

title 43.

Signature

Date

Printed Name

Title

This form is available online at

Submit completed applications via the Department’s Online

Tax Information System (OTIS) at

308

Mail to: Alaska Department of Revenue, 550 W 7th Ave STE 500, Anchorage AK 99501-3555

0405-308 Rev 01/13

1

1