Form Nrm-9621md-Md.2 - Annual Leave Deferral

ADVERTISEMENT

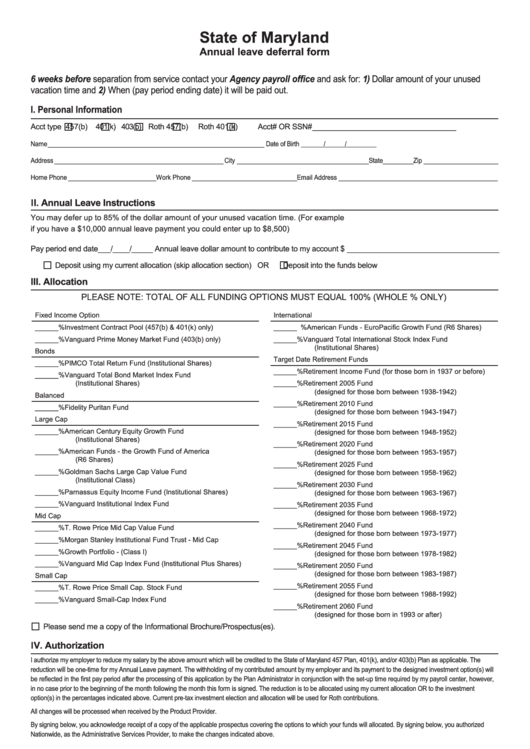

State of Maryland

Annual leave deferral form

6 weeks before separation from service contact your Agency payroll office and ask for: 1) Dollar amount of your unused

vacation time and 2) When (pay period ending date) it will be paid out.

I. Personal Information

Acct type

457(b)

401(k)

403(b)

Roth 457(b)

Roth 401(k)

Acct# OR SSN# __________________________________

Name ________________________________________________________________ Date of Birth

/

/

Address __________________________________________________ City _______________________________________ State_________Zip ______________________

Home Phone __________________________ Work Phone _______________________________ Email Address _______________________________________________

II. Annual Leave Instructions

You may defer up to 85% of the dollar amount of your unused vacation time. (For example

if you have a $10,000 annual leave payment you could enter up to $8,500)

Pay period end date___/____/_____ Annual leave dollar amount to contribute to my account $ ____________________________________

Deposit using my current allocation (skip allocation section) OR

Deposit into the funds below

III. Allocation

PLEASE NOTE: TOTAL OF ALL FUNDING OPTIONS MUST EQUAL 100% (WHOLE % ONLY)

Fixed Income Option

International

______ %

Investment Contract Pool (457(b) & 401(k) only)

______ %

American Funds - EuroPacific Growth Fund (R6 Shares)

______ %

Vanguard Prime Money Market Fund (403(b) only)

______ %

Vanguard Total International Stock Index Fund

(Institutional Shares)

Bonds

Target Date Retirement Funds

______ %

PIMCO Total Return Fund (Institutional Shares)

______ %

Retirement Income Fund (for those born in 1937 or before)

______ %

Vanguard Total Bond Market Index Fund

(Institutional Shares)

______ %

Retirement 2005 Fund

(designed for those born between 1938-1942)

Balanced

______ %

Retirement 2010 Fund

______ %

Fidelity Puritan Fund

(designed for those born between 1943-1947)

Large Cap

______ %

Retirement 2015 Fund

______ %

American Century Equity Growth Fund

(designed for those born between 1948-1952)

(Institutional Shares)

______ %

Retirement 2020 Fund

______ %

American Funds - the Growth Fund of America

(designed for those born between 1953-1957)

(R6 Shares)

______ %

Retirement 2025 Fund

______ %

Goldman Sachs Large Cap Value Fund

(designed for those born between 1958-1962)

(Institutional Class)

______ %

Retirement 2030 Fund

______ %

Parnassus Equity Income Fund (Institutional Shares)

(designed for those born between 1963-1967)

______ %

Vanguard Institutional Index Fund

______ %

Retirement 2035 Fund

(designed for those born between 1968-1972)

Mid Cap

______ %

Retirement 2040 Fund

______ %

T. Rowe Price Mid Cap Value Fund

(designed for those born between 1973-1977)

______ %

Morgan Stanley Institutional Fund Trust - Mid Cap

______ %

Retirement 2045 Fund

______ %

Growth Portfolio - (Class I)

(designed for those born between 1978-1982)

______ %

Vanguard Mid Cap Index Fund (Institutional Plus Shares)

______ %

Retirement 2050 Fund

(designed for those born between 1983-1987)

Small Cap

______ %

Retirement 2055 Fund

______ %

T. Rowe Price Small Cap. Stock Fund

(designed for those born between 1988-1992)

______ %

Vanguard Small-Cap Index Fund

______ %

Retirement 2060 Fund

(designed for those born in 1993 or after)

Please send me a copy of the Informational Brochure/Prospectus(es).

IV. Authorization

I authorize my employer to reduce my salary by the above amount which will be credited to the State of Maryland 457 Plan, 401(k), and/or 403(b) Plan as applicable. The

reduction will be one-time for my Annual Leave payment. The withholding of my contributed amount by my employer and its payment to the designed investment option(s) will

be reflected in the first pay period after the processing of this application by the Plan Administrator in conjunction with the set-up time required by my payroll center, however,

in no case prior to the beginning of the month following the month this form is signed. The reduction is to be allocated using my current allocation OR to the investment

option(s) in the percentages indicated above. Current pre-tax investment election and allocation will be used for Roth contributions.

All changes will be processed when received by the Product Provider.

By signing below, you acknowledge receipt of a copy of the applicable prospectus covering the options to which your funds will allocated. By signing below, you authorized

Nationwide, as the Administrative Services Provider, to make the changes indicated above.

I HAVE READ AND UNDERSTAND EACH OF THE STATEMENTS ON THE FRONT AND BACK OF THIS FORM, INCLUDING THE MEMORANDUM OF

UNDERSTANDING WHICH HAVE BEEN DRAFTED PURSUANT TO THE APPLICABLE PROVISIONS IN THE INTERNAL REVENUE CODE OF 1986, AS AMENDED. I

ACCEPT THESE TERMS AND UNDERSTAND THAT THESE STATEMENTS DO NOT COVER ALL THE DETAILS OF THE PLAN OR PRODUCTS.

Signature __________________________________________ Date _______________

NRM-9621MD-MD.2 (06/2016)

For help, please call 1-800-966-6355

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2