Upon discontinuance, disposition or transfer of all of your Michigan payroll and/or assets, taxes

become immediately due and payable, and your final Quarterly Tax Report must be f iled within 15

days.

TERMINATION OF COVERAGE WHEN COMPLETE TRANSFER OF MICHIGAN BUSINESS IS

INVOLVED. If you disposed of your Michigan business and the Agency finds that a total transfer of

your experience account is required, your coverage will be terminated as of the transfer date.

HOWEVER, should you have persons in your employ subsequent to the date on which your Michigan

payroll and/or assets were transferred, you are required to notify this Agency immediately because you

may be liable for taxes on your payroll regardless of the number of individuals in your employ.

DISCONTINUANCE OR PARTIAL TRANSFER OF MICHIGAN BUSINESS DOES NOT TERMINATE

YOUR COVERAGE. Even though you may have disposed of a part, or all of your Michigan business

in separate transactions, or discontinued all Michigan operations, you are required to continue to

report and pay taxes on any wages paid to Michigan workers whom you may employ until such time

as your coverage is legally terminated.

As prescribed in RuleR 421.115 of the Michigan Administrative Code, all documents,

agreement or records describing the transactions indicated in Part 1 Item 4, Part II, and Part III

above, should be kept available for examination by this Agency for six years.

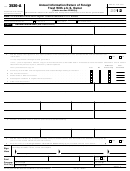

CERTIFICATION

I certify that the information contained in this report is accurate and complete to the best of my

knowledge and belief. I understand that if I fail to provide accurate and complete information

concerning the discontinuance of a business or the transfer of payroll or assets of a business, I

may be subject to penalties of up to four times the amount of resulting unpaid unemployment

taxes and imprisonment for up to five years.

Date:

Name:

(Title)

(Phone Number w/Area Code of Person Signing this Report)

Directions for Submitting Form:

You may submit this Form through your MiWAM account at

or

you may send a

completed UIA Form 1772 via fax to: (313) 456-2130 or email to:

EmployerLiability@michigan.gov.

If you

are mailing this Form, please send it to the following:

UNEMPLOYMENT INSURANCE AGENCY

Tax Office

P.O. Box 8068

Royal Oak, Michigan 48068-8068

QUESTIONS: If you have any questions, please contact the Office of Employer Ombudsman (OEO) at 1-

855-4UIAOEO (855-484-2636), 313-456-2300, or by e-mail at

OEO@michigan.gov

LARA

is

an

Equal

Opportunity Employer/Program.

1

1 2

2 3

3 4

4