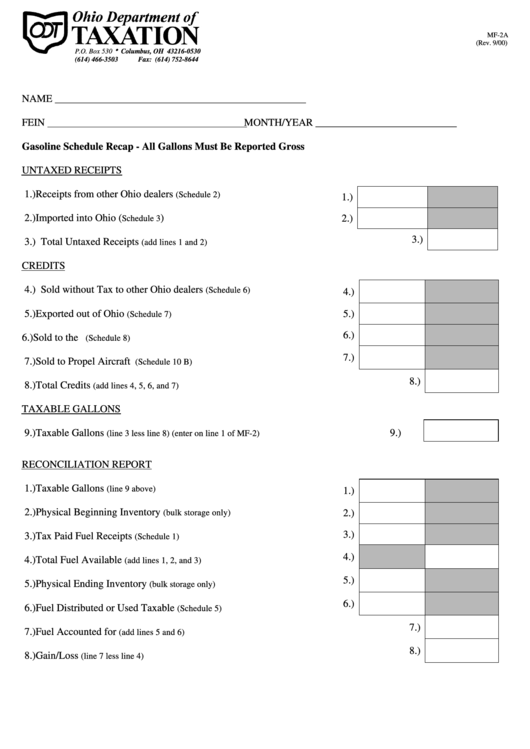

Form Mf-2a Gasoline Schedule Recap - All Gallons Must Be Reported Gross

ADVERTISEMENT

MF-2A

(Rev. 9/00)

P.O. Box 530D Columbus, OH 43216-0530

(614) 466-3503

Fax: (614) 752-8644

NAME ________________________________________________

FEIN

MONTH/YEAR ___________________________

Gasoline Schedule Recap - All Gallons Must Be Reported Gross

UNTAXED RECEIPTS

1.)

Receipts from other Ohio dealers

(Schedule 2)

1.)

2.)

Imported into Ohio (

)

2.)

Schedule 3

3.)

3.)

Total Untaxed Receipts

(add lines 1 and 2)

CREDITS

4.)

Sold without Tax to other Ohio dealers

(Schedule 6)

4.)

5.)

Exported out of Ohio

5.)

(Schedule 7)

6.)

6.)

Sold to the U.S. Government

(Schedule 8)

7.)

7.)

Sold to Propel Aircraft

(Schedule 10 B)

8.)

8.)

Total Credits

(add lines 4, 5, 6, and 7)

TAXABLE GALLONS

9.)

Taxable Gallons

9.)

(line 3 less line 8) (enter on line 1 of MF-2)

RECONCILIATION REPORT

1.)

Taxable Gallons

(line 9 above)

1.)

2.)

Physical Beginning Inventory

(bulk storage only)

2.)

3.)

3.)

Tax Paid Fuel Receipts

(Schedule 1)

4.)

4.)

Total Fuel Available

(add lines 1, 2, and 3)

5.)

5.)

Physical Ending Inventory

(bulk storage only)

6.)

6.)

Fuel Distributed or Used Taxable

(Schedule 5)

7.)

7.)

Fuel Accounted for

(add lines 5 and 6)

8.)

8.)

Gain/Loss

(line 7 less line 4)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1