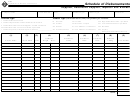

Form 81-015a - Schedule Of Disbursements Supplier, Restrictive Supplier, Importer And Blender Page 3

ADVERTISEMENT

Instructions

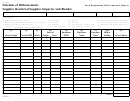

Supplier, Restrictive Supplier, Importer and Blenders Report - Schedule of Disbursements

Iowa Department of Revenue

General Instructions

Column (5) & (6): Purchaser - Enter the name and FEIN of the company

the product was sold to.

This schedule provides detail in support of gross gallons amount(s) shown on

Column (7):

Purchase Date - Enter the date the product was

your eFile & Pay return.

purchased (CCYYMMDD).

Each disbursement of product should be listed on a separate line.

Column (8):

Bill of Lading - Enter the identifying number (Bill of

Identifying Information

Lading number) from the document issued at the

Company Name, License Number and FEIN:

terminal when product is removed over the rack. In the

Enter the name and numbers (if applicable) for the name shown on the fuel

case of pipeline or barge movements, enter the

tax return.

pipeline or barge ticket number. Restrictive Suppliers

and Blenders use invoice number or other identifying

Schedule Code:

Enter schedule code number and literal on each page. Make a

numbers if bill of lading does not apply. Restrictive

separate Export schedule for each state and submit in duplicate.

Suppliers should also list tank wagon number.

Product Code:

Column (9):

Gross Gallons - Enter the gross amount of gallons

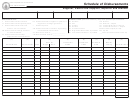

received. Provide a grand total for column 9 on the last

Enter fuel tax numeric code and description (example: 65 - gasoline).

page of each schedule type for that schedule.

Month/Year:

Enter the month and year covered by this return (CCYYMMDD).

Optional Schedules:

Sub-schedules can be used under each schedule if additional information is

needed. Sub-schedules must equal total of major schedule number.

Column Instructions

Column (1) & (2): Carrier - Enter the name and FEIN of the company that

transports the product.

Column (3):

Mode of Transport - Enter the mode of transport from

the terminal.Use one of the following: J = Truck

R = Rail B = Barge PL = Pipeline

S = Ship (Great Lakes or ocean marine vessel)

Column (4):

Point of Origin/Destination - Enter the location the

product was transported from and its destination (city

and state). When received into or from a terminal, use

the name and nine digit terminal code number assigned

by the Internal Revenue Service.

See the complete list of all IRS Terminal Codes at

81-015b (7/18/06)

,,id=6964,00.html

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3