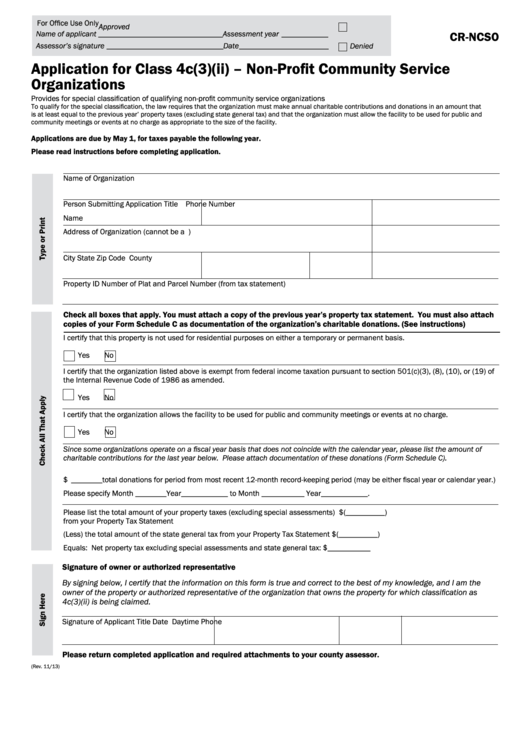

For Office Use Only

Approved

Name of applicant ________________________________Assessment year ____________

CR-NCSO

Denied

Assessor’s signature ______________________________Date _______________________

Application for Class 4c(3)(ii) – Non-Profit Community Service

Organizations

Provides for special classification of qualifying non-profit community service organizations

To qualify for the special classification, the law requires that the organization must make annual charitable contributions and donations in an amount that

is at least equal to the previous year’ property taxes (excluding state general tax) and that the organization must allow the facility to be used for public and

community meetings or events at no charge as appropriate to the size of the facility.

Applications are due by May 1, for taxes payable the following year.

Please read instructions before completing application.

Name of Organization

Person Submitting Application

Title

Phone Number

Name

Address of Organization (cannot be a P.O. Box number)

City

State

Zip Code

County

Property ID Number of Plat and Parcel Number (from tax statement)

Check all boxes that apply. You must attach a copy of the previous year’s property tax statement. You must also attach

copies of your Form Schedule C as documentation of the organization’s charitable donations. (See instructions)

I certify that this property is not used for residential purposes on either a temporary or permanent basis.

Yes

No

I certify that the organization listed above is exempt from federal income taxation pursuant to section 501(c)(3), (8), (10), or (19) of

the Internal Revenue Code of 1986 as amended.

Yes

No

I certify that the organization allows the facility to be used for public and community meetings or events at no charge.

Yes

No

Since some organizations operate on a fiscal year basis that does not coincide with the calendar year, please list the amount of

charitable contributions for the last year below. Please attach documentation of these donations (Form Schedule C).

$ ________ total donations for period from most recent 12-month record-keeping period (may be either fiscal year or calendar year.)

Please specify Month ________Year____________ to Month ___________ Year____________.

Please list the total amount of your property taxes (excluding special assessments)

$(__________)

from your Property Tax Statement

(Less) the total amount of the state general tax from your Property Tax Statement

$(__________)

Equals: Net property tax excluding special assessments and state general tax:

$___________

Signature of owner or authorized representative

By signing below, I certify that the information on this form is true and correct to the best of my knowledge, and I am the

owner of the property or authorized representative of the organization that owns the property for which classification as

4c(3)(ii) is being claimed.

Signature of Applicant

Title

Date

Daytime Phone

Please return completed application and required attachments to your county assessor.

(Rev. 11/13)

1

1 2

2