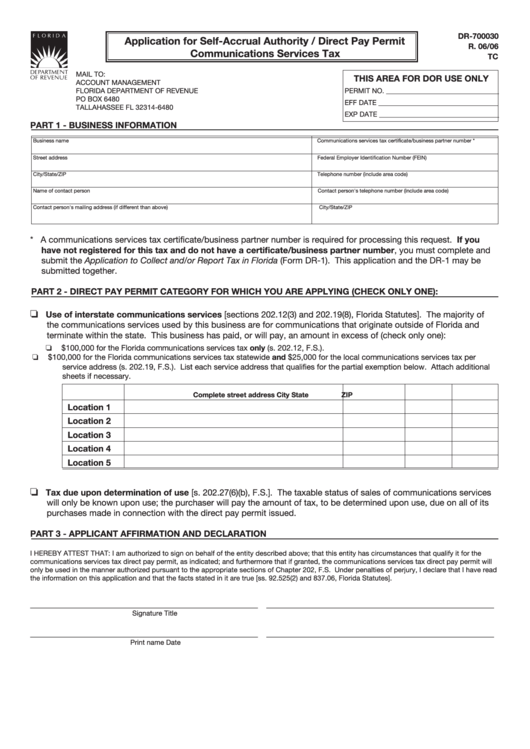

Form Dr-700030 - Application For Self-Accrual Authority / Direct Pay Permit Communications Services Tax

ADVERTISEMENT

DR-700030

application for self-accrual authority / Direct Pay Permit

R. 06/06

Communications services Tax

TC

MAIL TO:

This aRea foR DoR use only

ACCOUNT MANAgEMENT

FLORIDA DEPARTMENT OF REVENUE

PERMIT NO. ________________________________

PO BOx 6480

EFF DATE __________________________________

TALLAHASSEE FL 32314-6480

ExP DATE __________________________________

PaRT 1 - Business infoRmaTion

Business name

Communications services tax certificate/business partner number *

Street address

Federal Employer Identification Number (FEIN)

City/State/ZIP

Telephone number (include area code)

Name of contact person

Contact person's telephone number (include area code)

Contact person's mailing address (if different than above)

City/State/ZIP

* A communications services tax certificate/business partner number is required for processing this request. if you

have not registered for this tax and do not have a certificate/business partner number, you must complete and

submit the Application to Collect and/or Report Tax in Florida (Form DR-1). This application and the DR-1 may be

submitted together.

PaRT 2 - DiReCT Pay PeRmiT CaTegoRy foR WhiCh you aRe aPPlying (CheCk only one):

❏

use of interstate communications services [sections 202.12(3) and 202.19(8), Florida Statutes]. The majority of

the communications services used by this business are for communications that originate outside of Florida and

terminate within the state. This business has paid, or will pay, an amount in excess of (check only one):

❏ $100,000 for the Florida communications services tax only (s. 202.12, F.S.).

❏ $100,000 for the Florida communications services tax statewide and $25,000 for the local communications services tax per

service address (s. 202.19, F.S.). List each service address that qualifies for the partial exemption below. Attach additional

sheets if necessary.

Complete street address

City

state

ZiP

location 1

location 2

location 3

location 4

location 5

❏

Tax due upon determination of use [s. 202.27(6)(b), F.S.]. The taxable status of sales of communications services

will only be known upon use; the purchaser will pay the amount of tax, to be determined upon use, due on all of its

purchases made in connection with the direct pay permit issued.

PaRT 3 - aPPliCanT affiRmaTion anD DeClaRaTion

I HEREBY ATTEST THAT: I am authorized to sign on behalf of the entity described above; that this entity has circumstances that qualify it for the

communications services tax direct pay permit, as indicated; and furthermore that if granted, the communications services tax direct pay permit will

only be used in the manner authorized pursuant to the appropriate sections of Chapter 202, F.S. Under penalties of perjury, I declare that I have read

the information on this application and that the facts stated in it are true [ss. 92.525(2) and 837.06, Florida Statutes].

____________________________________________________

____________________________________________________

Signature

Title

____________________________________________________

____________________________________________________

Print name

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2