Clear Form

DO NOT WRITE IN THIS AREA

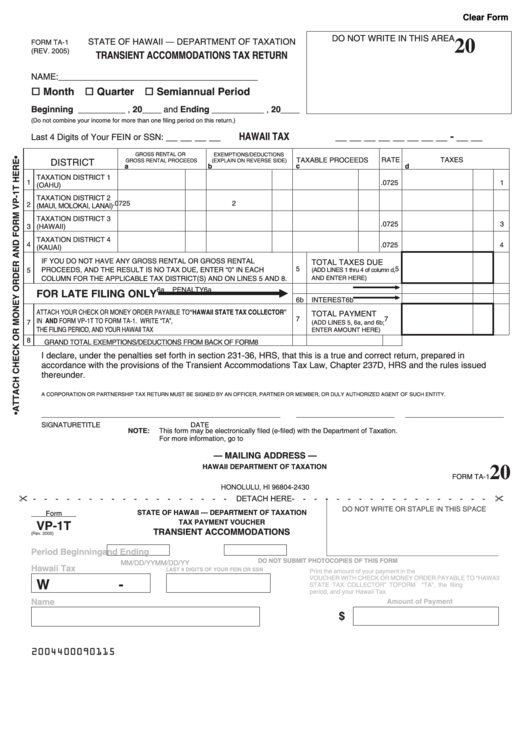

STATE OF HAWAII — DEPARTMENT OF TAXATION

20

FORM TA-1

(REV. 2005)

TRANSIENT ACCOMMODATIONS TAX RETURN

NAME:__________________________________________

o Month o Quarter o Semiannual Period

Beginning __________ , 20____ and Ending ___________ , 20____

(Do not combine your income for more than one filing period on this return.)

__ __ __ __

HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __

Last 4 Digits of Your FEIN or SSN:

GROSS RENTAL OR

EXEMPTIONS/DEDUCTIONS

TAXABLE PROCEEDS

RATE

TAXES

GROSS RENTAL PROCEEDS

(EXPLAIN ON REVERSE SIDE)

DISTRICT

a

b

c

d

TAXATION DISTRICT 1

1

.0725

1

(OAHU)

TAXATION DISTRICT 2

.0725

2

2

(MAUI, MOLOKAI, LANAI)

TAXATION DISTRICT 3

.0725

3

3

(HAWAII)

TAXATION DISTRICT 4

4

.0725

4

(KAUAI)

IF YOU DO NOT HAVE ANY GROSS RENTAL OR GROSS RENTAL

TOTAL TAXES DUE

5

5

PROCEEDS, AND THE RESULT IS NO TAX DUE, ENTER “0” IN EACH

5

(ADD LINES 1 thru 4 of column d,

COLUMN FOR THE APPLICABLE TAX DISTRICT(S) AND ON LINES 5 AND 8.

AND ENTER HERE)

6a

PENALTY

6a

FOR LATE FILING ONLY

6b

INTEREST

6b

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO “HAWAII STATE TAX COLLECTOR”

TOTAL PAYMENT

7

7

IN U.S. DOLLARS DRAWN ON ANY U.S. BANK AND FORM VP-1T TO FORM TA-1. WRITE “TA”,

7

(ADD LINES 5, 6a, and 6b;

THE FILING PERIOD, AND YOUR HAWAII TAX I.D. NO. ON YOUR CHECK OR MONEY ORDER.

ENTER AMOUNT HERE)

8

GRAND TOTAL EXEMPTIONS/DEDUCTIONS FROM BACK OF FORM

8

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in

accordance with the provisions of the Transient Accommodations Tax Law, Chapter 237D, HRS and the rules issued

thereunder.

A CORPORATION OR PARTNERSHIP TAX RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT OF SUCH ENTITY.

SIGNATURE

TITLE

DATE

NOTE:

This form may be electronically filed (e-filed) with the Department of Taxation.

For more information, go to

— MAILING ADDRESS —

HAWAII DEPARTMENT OF TAXATION

20

FORM TA-1

P.O. BOX 2430

HONOLULU, HI 96804-2430

" -

"

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

DETACH HERE-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

Form

TAX PAYMENT VOUCHER

VP-1T

TRANSIENT ACCOMMODATIONS

(Rev. 2005)

Period Beginning

and Ending

DO NOT SUBMIT PHOTOCOPIES OF THIS FORM

MM/DD/YY

MM/DD/YY

Hawaii Tax I.D. No.

LAST 4 DIGITS OF YOUR FEIN OR SSN

Print the amount of your payment in the space provided. ATTACH THIS

VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO “HAWAII

W

-

STATE TAX COLLECTOR” TO FORM TA-1. Write “TA”, the filing

period, and your Hawaii Tax I.D. No. on your check or money order.

Name

Amount of Payment

$

2004400090115

1

1 2

2