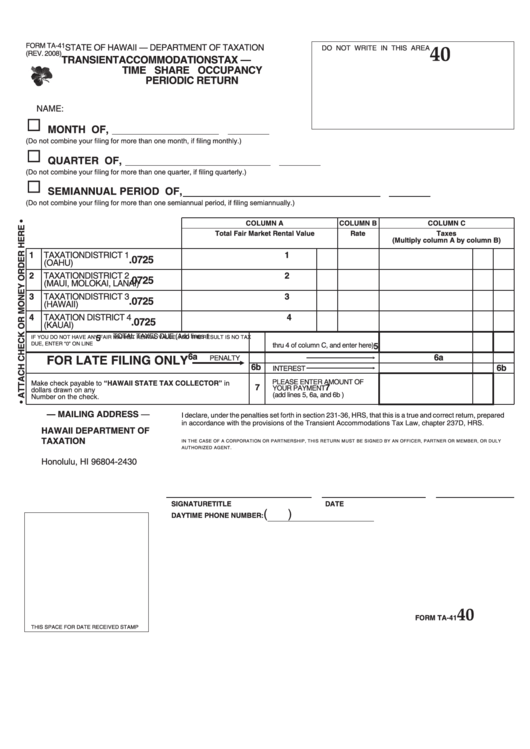

Form Ta-41 - Transient Accommodations Tax - Time Share Occupancy Periodic Return

ADVERTISEMENT

FORM TA-41

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE IN THIS AREA

40

(REV. 2008)

TRANSIENT ACCOMMODATIONS TAX —

TIME SHARE OCCUPANCY

PERIODIC RETURN

NAME:

9

MONTH OF

,

(Do not combine your filing for more than one month, if filing monthly.)

9

T.S.O. REG. NO. ____________

QUARTER OF

,

(Do not combine your filing for more than one quarter, if filing quarterly.)

9

SEMIANNUAL PERIOD OF

,

(Do not combine your filing for more than one semiannual period, if filing semiannually.)

COLUMN A

COLUMN B

COLUMN C

Total Fair Market Rental Value

Rate

Taxes

(Multiply column A by column B)

1

TAXATION DISTRICT 1

1

.0725

(OAHU)

2

TAXATION DISTRICT 2

2

.0725

(MAUI, MOLOKAI, LANAI)

3

TAXATION DISTRICT 3

3

.0725

(HAWAII)

4

TAXATION DISTRICT 4

4

.0725

(KAUAI)

TOTAL TAXES DUE (Add lines 1

IF YOU DO NOT HAVE ANY FAIR MARKET RENTAL VALUE, AND THE RESULT IS NO TAX

5

DUE, ENTER “0” ON LINE 5. THIS RETURN MUST BE FILED.

thru 4 of column C, and enter here)

5

6a

6a

FOR LATE FILING ONLY

PENALTY

6b

6b

INTEREST

PLEASE ENTER AMOUNT OF

Make check payable to “HAWAII STATE TAX COLLECTOR” in U.S.

7

7

YOUR PAYMENT

dollars drawn on any U.S. bank. Write your T.S.O. Registration

(add lines 5, 6a, and 6b )

Number on the check.

— MAILING ADDRESS —

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared

in accordance with the provisions of the Transient Accommodations Tax Law, chapter 237D, HRS.

HAWAII DEPARTMENT OF

TAXATION

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY

AUTHORIZED AGENT.

P.O. Box 2430

Honolulu, HI 96804-2430

SIGNATURE

TITLE

DATE

(

)

DAYTIME PHONE NUMBER:

40

FORM TA-41

THIS SPACE FOR DATE RECEIVED STAMP

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1