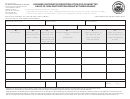

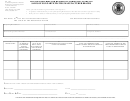

Form Rpd 41188 - Non-Participating Manufacturer Brand Cigarettes Distributed Or Sold Page 2

ADVERTISEMENT

RPD 41188

State of New Mexico - Taxation and Revenue Department

Rev. 06/2007

Non-Participating Manufacturer Brand Cigarettes Distributed or Sold - Instructions

Who Must File: A cigarette distributor, manufacturer or retailer who distributes or sells cigarettes or

tobacco products tax should be reported.

“roll-your-own” tobacco products manufactured by a non-participating manufacturer (NPM) must

“Manufacturer” means the first manufacturer, processor, or importer of a tobacco product intended

submit to the Taxation and Revenue Department a list by brand family, of the total number of

for legal marketing in the United States. The existence of a sufficient Surgeon General’s warning

cigarettes, or equivalent stick count in the case of “roll-your-own”, distributed or sold if you affixed a

statement on the package indicates intent to market the product within the U.S. In the case of “roll-

New Mexico Cigarette Tax Stamp or for which you paid the tobacco excise tax to the Department. If

your-own tobacco” imported from another country, the first importer who intended to market product

you are a licensed distributor, include cigarettes distributed or sold in the report month to which you

within the U.S. is considered to be the “manufacturer”.

have affixed New Mexico Cigarette Tax Stamps, or “roll-your-own” tobacco products distributed or

“Distributor” means any person who is required to obtain a license to engage in the business of

sold in the report month to which you have paid the tobacco excise tax due. If you are a manufacturer

selling cigarettes in New Mexico pursuant to Section 7-12-9.1 NMSA 1978, and who is required to

or retailer, include “roll-your-own” tobacco products sold in the report month, for which you have paid

obtain a New Mexico license according to the Cigarette Tax Act.

the tobacco excise tax to the Department. Attach Form RPD-41188, Non-participating Manufacturer

Instructions for Completing this Form: Enter your business name and New Mexico CRS

Brand Cigarettes Distributed or Sold, to Form RPD-41315, Cigarette Distributor’s Monthly Report,

Identification Number as they appear on the New Mexico CRS registration certificate. Enter the

to Form RPD-41311, Cigarette Manufacturer’s Monthly Report, or to Form RPD-41192, Tobacco

federal employer identification number (FEIN) or social securtiy number (SSN); if you are a manu-

Products Tax Return, if you are a retailer who is a first purchaser of tobacco, and mail to the

facturer or distributor, enter the New Mexico cigarette distributor’s or manufacturer’s license number,

Department by the 25th day of the month following the close of the report month. For assistance call

and a contact name and telephone number of an individual authorized to answer questions about this

(505) 827-6842.

report. The authorized contact must also sign the report. Provide the information requested about

About Non-participating Manufacturers. As part of the November 23, 1998, Tobacco Master

cigarettes and roll-your-own tobacco products that were made by an NPM, that your organization

Settlement Agreement (MSA) between states and tobacco product manufacturers, tobacco product

affixed a New Mexico cigarette tax stamp, or otherwise paid the tobacco excise tax, and that you

manufacturers selling cigarettes (including “roll-your-own”) in New Mexico that have not become

distributed or sold during the report month.

parties to the MSA, are required to establish a qualified escrow fund and to deposit into that fund a

Important: Do not report tax-exempt sales or sales of brands made by participating manufacturers.

certain percentage of the proceeds from each cigarette sold in New Mexico. To ensure compliance,

Do not report cigarettes to which you have affixed a New Mexico Tax-exempt stamp. Do not include

the New Mexico Taxation and Revenue Department is required to collect information on non-

cigarettes that were purchased with a New Mexico cigarette excise tax stamp already affixed.

participating and foreign-manufactured brands of cigarettes sold or distributed for sale in New Mexico.

See Sections 6-4-12 and 6-4-13 NMSA 1978. The Department provides a current list of participating

Column A: Enter the full brand family name of the qualifying NPM cigarettes distributed or sold during

manufacturers under the MSA to each new filer. You may contact the Department to obtain a list, or

the report month. Do not abbreviate the brand family name. All styles of cigarettes, such as regular,

you may visit The list is maintained by the National Association of Attorneys General

menthol, light, etc., sold under the same trademark or brand family, must be included in the same line

and is posted on their web site.

item. For example, the tobacco product “Alpha Bravo Gold Lights” should be reported within the

same line item as all “Alpha Bravo Gold” products.

Definitions:

Column B: Enter the number of qualifying NPM cigarette sticks distributed or sold in New Mexico

“Cigarette” means any roll of tobacco or any substitute for tobacco wrapped in paper or other

during the report month.

substance not containing tobacco; or a roll of tobacco that is wrapped in any substance containing

Column C: Enter the number of ounces of NPM roll-your-own tobacco distributed or sold in New

tobacco, other than 100% natural leaf tobacco, and which because of its appearance, the type of

Mexico during the report month.

tobacco used in the filler, its packaging and labeling, or its marketing and advertising, is likely to be

Column D: If known, enter the name and address of the non-participating manufacturer who

offered to, or purchased by consumers as a cigarette, and includes bidis and kreteks. “Cigarette”

produced the tobacco product.

includes certain small cigars sold in packages similar to cigarettes. If a small cigar is wrapped in

Column E: Enter the name and address of the distributor or wholesaler from whom you purchased

something other than 100% tobacco, or because of its appearance, the type of tobacco used in the

the NPM product, if different from column d.

filler, its packaging and labeling, or its marketing and advertising, is likely to be offered to, or pur-

Column F: If known, enter the name and address of the importer if the product is a foreign manufac-

chased by consumers as a cigarette, it is a cigarette for purposes of the Cigarette Tax Act. Only

tured brand.

cigarettes sold which are subject to the cigarette excise tax must be reported.

“Roll-your-own tobacco” means a product which contains nicotine, is intended to be burned or

Sign the form, attach to Form RPD-41315, Cigarette Distributor’s Monthly Cigarette Distributor

heated under ordinary conditions of use, and because of its appearance, packaging and labeling, or

Report, Form RPD-41311, Cigarette Manufacturer’s Monthly Distribution Report, or Form RPD-

the type of tobacco used, is likely to be offered to, or purchased by a consumer as a “roll-your-own”

41192, Tobacco Products Tax Return, and mail on or before the 25th day following the close of the

cigarette product. The latter part of this description regarding intended or likely use for the product is

report month. Please include the contact information of an individual authorized to speak for your

important, and product labeling is generally the determining factor. Tobacco which might popularly be

business. Mail to: New Mexico Taxation and Revenue Department, Cigarette Tax Unit, P.O.

considered a “dual use” tobacco (both as a pipe tobacco and a “roll-your-own” tobacco) should be

Box 25123, Santa Fe, NM 87504-5123

evaluated based on product labeling. Only “roll-your-own” tobacco sold which is subject to the state

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2