Form Ct-25 Schedule C - Sales And Transfers Of Unstamped Cigarettes Outside Of Connecticut

ADVERTISEMENT

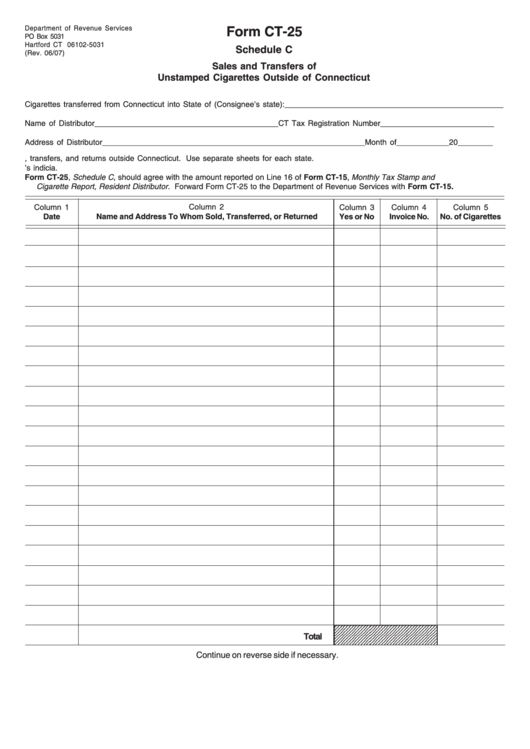

Department of Revenue Services

Form CT-25

PO Box 5031

Hartford CT 06102-5031

Schedule C

(Rev. 06/07)

Sales and Transfers of

Unstamped Cigarettes Outside of Connecticut

Cigarettes transferred from Connecticut into State of (Consignee’s state): __________________________________________________

Name of Distributor __________________________________________ CT Tax Registration Number __________________________

Address of Distributor ____________________________________________________________ Month of ____________ 20 ________

1. Include all sales, transfers, and returns outside Connecticut. Use separate sheets for each state.

2. Indicate in Column 3 whether or not the cigarettes are stamped with the consignee state’s indicia.

3. The total of Form CT-25, Schedule C, should agree with the amount reported on Line 16 of Form CT-15, Monthly Tax Stamp and

Cigarette Report, Resident Distributor. Forward Form CT-25 to the Department of Revenue Services with Form CT-15.

Column 1

Column 2

Column 3

Column 4

Column 5

Date

Name and Address To Whom Sold, Transferred, or Returned

Yes or No

Invoice No.

No. of Cigarettes

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

Total

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

Continue on reverse side if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2