Form Ct-29 - Schedule G - Sales And Transfers Of Unstamped Cigarettes To Other Connecticut Distributors - 2007

ADVERTISEMENT

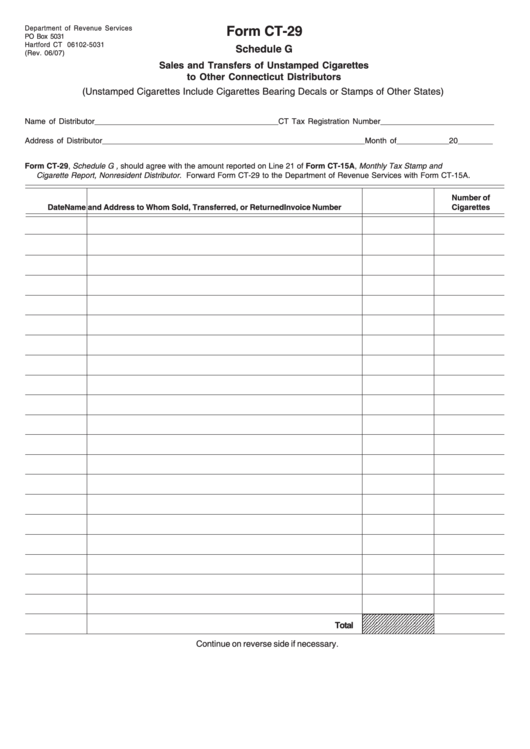

Form CT-29

Department of Revenue Services

PO Box 5031

Hartford CT 06102-5031

Schedule G

(Rev. 06/07)

Sales and Transfers of Unstamped Cigarettes

to Other Connecticut Distributors

(Unstamped Cigarettes Include Cigarettes Bearing Decals or Stamps of Other States)

Name of Distributor __________________________________________ CT Tax Registration Number __________________________

Address of Distributor ____________________________________________________________ Month of ____________ 20 ________

1. Nonresident distributors selling or transferring unstamped cigarettes to other Connecticut distributors must file this schedule.

2. The total of Form CT-29, Schedule G , should agree with the amount reported on Line 21 of Form CT-15A, Monthly Tax Stamp and

Cigarette Report, Nonresident Distributor. Forward Form CT-29 to the Department of Revenue Services with Form CT-15A.

Number of

Date

Name and Address to Whom Sold, Transferred, or Returned

Invoice Number

Cigarettes

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Total

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Continue on reverse side if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2