Reading Earnings Tax Return Form 2006 - Ohio

ADVERTISEMENT

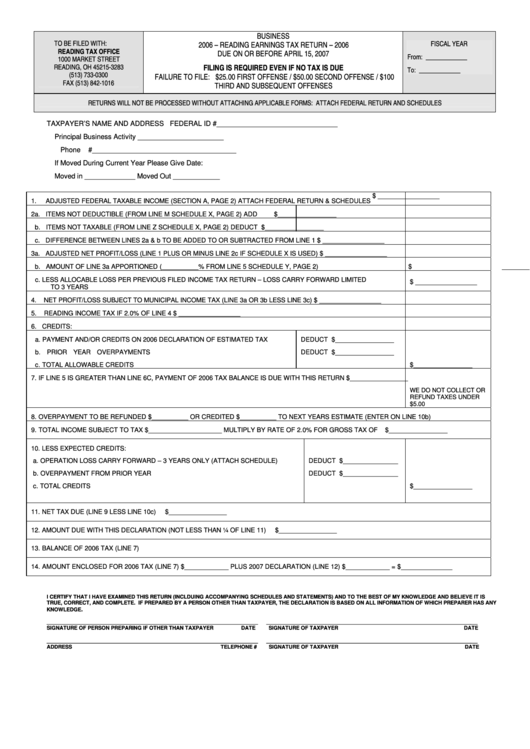

BUSINESS

TO BE FILED WITH:

FISCAL YEAR

2006 – READING EARNINGS TAX RETURN – 2006

READING TAX OFFICE

DUE ON OR BEFORE APRIL 15, 2007

From:

_____________

1000 MARKET STREET

READING, OH 45215-3283

FILING IS REQUIRED EVEN IF NO TAX IS DUE

To:

_____________

(513) 733-0300

FAILURE TO FILE: $25.00 FIRST OFFENSE / $50.00 SECOND OFFENSE / $100

FAX (513) 842-1016

THIRD AND SUBSEQUENT OFFENSES

RETURNS WILL NOT BE PROCESSED WITHOUT ATTACHING APPLICABLE FORMS: ATTACH FEDERAL RETURN AND SCHEDULES

TAXPAYER’S NAME AND ADDRESS

FEDERAL ID #_______________________________

Principal Business Activity ______________________

Phone #_____________________________________

If Moved During Current Year Please Give Date:

Moved in _____________ Moved Out ____________

$ _________________

1.

ADJUSTED FEDERAL TAXABLE INCOME (SECTION A, PAGE 2) ATTACH FEDERAL RETURN & SCHEDULES

2a. ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X, PAGE 2)

ADD

$________________

b. ITEMS NOT TAXABLE (FROM LINE Z SCHEDULE X, PAGE 2)

DEDUCT $________________

c. DIFFERENCE BETWEEN LINES 2a & b TO BE ADDED TO OR SUBTRACTED FROM LINE 1

$ _________________

3a. ADJUSTED NET PROFIT/LOSS (LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE X IS USED)

$ _________________

b. AMOUNT OF LINE 3a APPORTIONED (__________% FROM LINE 5 SCHEDULE Y, PAGE 2)

$ _________________

c. LESS ALLOCABLE LOSS PER PREVIOUS FILED INCOME TAX RETURN – LOSS CARRY FORWARD LIMITED

$ _________________

TO 3 YEARS

4.

NET PROFIT/LOSS SUBJECT TO MUNICIPAL INCOME TAX (LINE 3a OR 3b LESS LINE 3c)

$ _________________

5.

READING INCOME TAX IF 2.0% OF LINE 4

$ _________________

6. CREDITS:

a. PAYMENT AND/OR CREDITS ON 2006 DECLARATION OF ESTIMATED TAX

DEDUCT $________________

b. PRIOR YEAR OVERPAYMENTS

DEDUCT $________________

c. TOTAL ALLOWABLE CREDITS

$________________

7. IF LINE 5 IS GREATER THAN LINE 6C, PAYMENT OF 2006 TAX BALANCE IS DUE WITH THIS RETURN

$________________

WE DO NOT COLLECT OR

REFUND TAXES UNDER

$5.00

8. OVERPAYMENT TO BE REFUNDED $__________ OR CREDITED $__________ TO NEXT YEARS ESTIMATE (ENTER ON LINE 10b)

9. TOTAL INCOME SUBJECT TO TAX $____________________ MULTIPLY BY RATE OF 2.0% FOR GROSS TAX OF

$________________

10. LESS EXPECTED CREDITS:

a. OPERATION LOSS CARRY FORWARD – 3 YEARS ONLY (ATTACH SCHEDULE)

DEDUCT $_______________

b. OVERPAYMENT FROM PRIOR YEAR

DEDUCT $_______________

c. TOTAL CREDITS

$________________

11. NET TAX DUE (LINE 9 LESS LINE 10c)

$________________

12. AMOUNT DUE WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 11)

$________________

13. BALANCE OF 2006 TAX (LINE 7)

14. AMOUNT ENCLOSED FOR 2006 TAX (LINE 7) $____________ PLUS 2007 DECLARATION (LINE 12) $____________ = $______________

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLDUING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEVE IT IS

TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY

.

KNOWLEDGE

______________________________________________________________

______________________________________________________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER

DATE

______________________________________________________________

______________________________________________________________

ADDRESS

TELEPHONE #

SIGNATURE OF TAXPAYER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2