Reset Form

Print Form

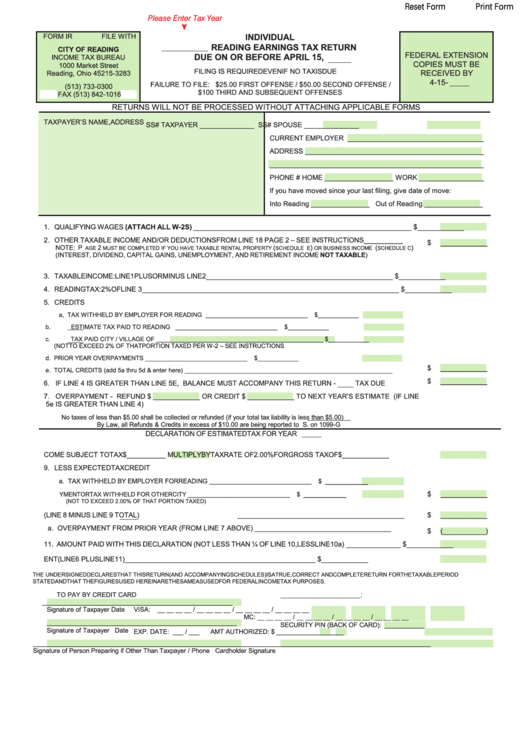

Please Enter Tax Year

INDIVIDUAL

FORM IR

FILE WITH

READING EARNINGS TAX RETURN

CITY OF READING

FEDERAL EXTENSION

DUE ON OR BEFORE APRIL 15,

INCOME TAX BUREAU

COPIES MUST BE

1000 Market Street

FILING IS REQUIRED EVEN IF NO TAX IS DUE

RECEIVED BY

Reading, Ohio 45215-3283

4-15-

FAILURE TO FILE: $25.00 FIRST OFFENSE / $50.00 SECOND OFFENSE /

(513) 733-0300

$100 THIRD AND SUBSEQUENT OFFENSES

FAX (513) 842-1016

RETURNS WILL NOT BE PROCESSED WITHOUT ATTACHING APPLICABLE FORMS

TAXPAYER’S NAME, ADDRESS

SS# TAXPAYER ______________ SS# SPOUSE ______________

CURRENT EMPLOYER ___________________________________

ADDRESS ______________________________________________

_______________________________________________________

PHONE # HOME __________________ WORK _________________

If you have moved since your last filing, give date of move:

Into Reading _______________ Out of Reading _______________

1. QUALIFYING WAGES (ATTACH ALL W-2S) ________________________________________________________

$

____________

2. OTHER TAXABLE INCOME AND/OR DEDUCTIONS FROM LINE 18 PAGE 2 – SEE INSTRUCTIONS __________

$

____________

NOTE: P

2

(

)

(

)

AGE

MUST BE COMPLETED IF YOU HAVE TAXABLE RENTAL PROPERTY

SCHEDULE E

OR BUSINESS INCOME

SCHEDULE C

(INTEREST, DIVIDEND, CAPITAL GAINS, UNEMPLOYMENT, AND RETIREMENT INCOME NOT TAXABLE)

3. TAXABLE INCOME: LINE 1 PLUS OR MINUS LINE 2 ________________________________________________

$

____________

4. READING TAX: 2% OF LINE 3 __________________________________________________________________

$

____________

5. CREDITS

a, TAX WITHHELD BY EMPLOYER FOR READING

______________________________

$ ____________

b.

ESTIMATE TAX PAID TO READING

______________________________

$ ____________

c.

TAX PAID CITY / VILLAGE OF _________________________________________________

$ ____________

(NOT TO EXCEED 2% OF THAT PORTION TAXED PER W-2 – SEE INSTRUCTIONS

d. PRIOR YEAR OVERPAYMENTS

______________________________

$ ____________

$

____________

e. TOTAL CREDITS (add 5a thru 5d & enter here) _____________________________________________________________

$

____________

6. IF LINE 4 IS GREATER THAN LINE 5E, BALANCE MUST ACCOMPANY THIS RETURN -

TAX DUE

7. OVERPAYMENT - REFUND $ ____________ OR CREDIT $ ____________ TO NEXT YEAR’S ESTIMATE (IF LINE

5e IS GREATER THAN LINE 4)

No taxes of less than $5.00 shall be collected or refunded (if your total tax liability is less than $5.00)

By Law, all Refunds & Credits in excess of $10.00 are being reported to the I.R.S. on 1099-G

DECLARATION OF ESTIMATED TAX FOR YEAR

8. TOTAL INCOME SUBJECT TO TAX $ __________ MULTIPLY BY TAX RATE OF 2.00% FOR GROSS TAX OF

$

____________

9. LESS EXPECTED TAX CREDIT

___________

a. TAX WITHHELD BY EMPLOYER FOR READING

______________________________

$

___________

$

____________

b. PAYMENT OR TAX WITHHELD FOR OTHER CITY

______________________________

$

(NOT TO EXCEED 2.00% OF THAT PORTION TAXED)

10. NET TAX DUE FOR

(LINE 8 MINUS LINE 9 TOTAL) ____________________________________________

$

____________

a. OVERPAYMENT FROM PRIOR YEAR (FROM LINE 7 ABOVE) ___________________________________

$

(___________)

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 10, LESS LINE 10a) ______________

$

____________

12. TOTAL OF THIS PAYMENT (LINE 6 PLUS LINE 11)_________________________________________________

$

____________

THE UNDERSIGNED DECLARES THAT THIS RETURN (AND ACCOMPANYING SCHEDULES) IS A TRUE, CORRECT AND COMPLETE RETURN FOR THE TAXABLE PERIOD

STATED AND THAT THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES.

TO PAY BY CREDIT CARD

:

______________________________________________________

Signature of Taxpayer

Date

VISA:

__ __ __ __ / __ __ __ __ / __ __ __ __ / __ __ __ __

MC:

__ __ __ __ / __ __ __ __ / __ __ __ __ / __ __ __ __

______________________________________________________

SECURITY PIN (BACK OF CARD): __________

Signature of Taxpayer

Date

EXP. DATE: ___ / ___

AMT AUTHORIZED: $ ___________________

______________________________________________________

___________________________________________________________

Signature of Person Preparing if Other Than Taxpayer / Phone

Cardholder Signature

1

1 2

2