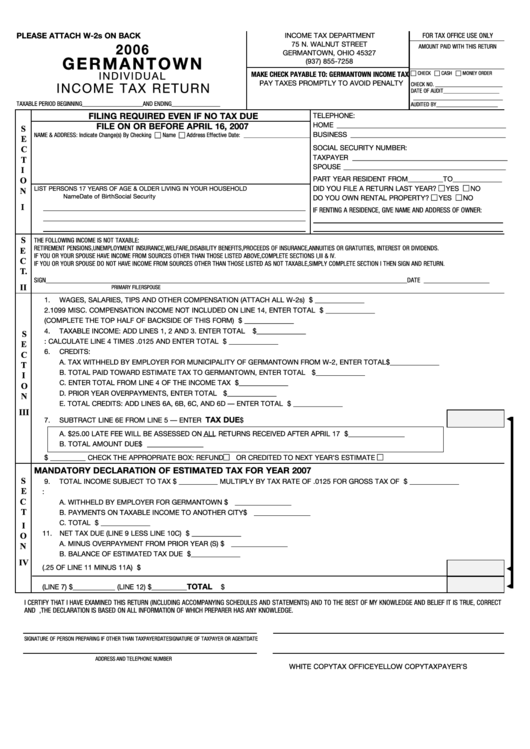

Germantown Individual Income Tax Return - Ohio, Income Tax Department - 2006

ADVERTISEMENT

PLEASE ATTACH W-2s ON BACK

INCOME TAX DEPARTMENT

FOR TAX OFFICE USE ONLY

75 N. WALNUT STREET

2 0 0 6

AMOUNT PAID WITH THIS RETURN

GERMANTOWN, OHIO 45327

G E R M A N T O W N

(937) 855-7258

CHECK

CASH

MONEY ORDER

MAKE CHECK PAYABLE TO: GERMANTOWN INCOME TAX

I N D I V I D U A L

PAY TAXES PROMPTLY TO AVOID PENALTY

CHECK NO. ________________________

INCOME TAX RETURN

DATE OF AUDIT ____________________

________________________________

TAXABLE PERIOD BEGINNING ________________ ____ AND ENDING ____________ ____

AUDITED BY ______________________

FILING REQUIRED EVEN IF NO TAX DUE

TELEPHONE:

S

HOME ________________________________________________

FILE ON OR BEFORE APRIL 16, 2007

E

BUSINESS ____________________________________________

NAME & ADDRESS: Indicate Change(s) By Checking

Name

Address Effective Date: ______________________

C

SOCIAL SECURITY NUMBER:

T

TAXPAYER ____________________________________________

I

SPOUSE ______________________________________________

O

PART YEAR RESIDENT FROM __________TO______________

N

DID YOU FILE A RETURN LAST YEAR?

YES

NO

LIST PERSONS 17 YEARS OF AGE & OLDER LIVING IN YOUR HOUSEHOLD

I

Name

Date of Birth

Social Security No.

Relationship

DO YOU OWN RENTAL PROPERTY?

YES

NO

IF RENTING A RESIDENCE, GIVE NAME AND ADDRESS OF OWNER:

S

E

THE FOLLOWING INCOME IS NOT TAXABLE:

RETIREMENT PENSIONS, UNEMPLOYMENT INSURANCE, WELFARE, DISABILITY BENEFITS, PROCEEDS OF INSURANCE, ANNUITIES OR GRATUITIES, INTEREST OR DIVIDENDS.

C

IF YOU OR YOUR SPOUSE HAVE INCOME FROM SOURCES OTHER THAN THOSE LISTED ABOVE, COMPLETE SECTIONS I, III & IV.

T.

IF YOU OR YOUR SPOUSE DO NOT HAVE INCOME FROM SOURCES OTHER THAN THOSE LISTED AS NOT TAXABLE, SIMPLY COMPLETE SECTION I THEN SIGN AND RETURN.

II

SIGN ______________________________________________________

________________________________________________________ DATE ____________________

PRIMARY FILER

SPOUSE

1.

WAGES, SALARIES, TIPS AND OTHER COMPENSATION (ATTACH ALL W-2s) .......................................................................... $ ______________

2.

1099 MISC. COMPENSATION INCOME NOT INCLUDED ON LINE 14, ENTER TOTAL .............................................................. $ ______________

3.

OTHER TAXABLE INCOME OR DEDUCTIONS (COMPLETE THE TOP HALF OF BACKSIDE OF THIS FORM) .......................... $ ______________

S

4.

TAXABLE INCOME: ADD LINES 1, 2 AND 3. ENTER TOTAL ........................................................................................................ $ ______________

E

5.

GERMANTOWN TAX: CALCULATE LINE 4 TIMES .0125 AND ENTER TOTAL ............................................................................ $ ______________

C

6.

CREDITS:

T

A. TAX WITHHELD BY EMPLOYER FOR MUNICIPALITY OF GERMANTOWN FROM W-2, ENTER TOTAL $ ______________

I

B. TOTAL PAID TOWARD ESTIMATE TAX TO GERMANTOWN, ENTER TOTAL .......................................... $ ______________

O

C. ENTER TOTAL FROM LINE 4 OF THE INCOME TAX WORKSHEET ........................................................ $ ______________

N

D. PRIOR YEAR OVERPAYMENTS, ENTER TOTAL ...................................................................................... $ ______________

III

E. TOTAL CREDITS: ADD LINES 6A, 6B, 6C, AND 6D — ENTER TOTAL .................................................................................... $ ______________

TAX DUE

7.

SUBTRACT LINE 6E FROM LINE 5 — ENTER TOTAL ............................................................................................

$

A. $25.00 LATE FEE WILL BE ASSESSED ON ALL RETURNS RECEIVED AFTER APRIL 17 ............ $ ________________

B. TOTAL AMOUNT DUE ...................................................................................................................... $ ________________

8.

OVERPAYMENT IS $ __________ CHECK THE APPROPRIATE BOX: REFUND

OR CREDITED TO NEXT YEAR’S ESTIMATE

MANDATORY DECLARATION OF ESTIMATED TAX FOR YEAR 2007

S

E

9.

TOTAL INCOME SUBJECT TO TAX $ ___________ MULTIPLY BY TAX RATE OF .0125 FOR GROSS TAX OF .......................... $ ______________

C

10.

LESS EXPECTED TAX CREDITS:

T

A. WITHHELD BY EMPLOYER FOR GERMANTOWN .............................................................................. $ ________________

B. PAYMENTS ON TAXABLE INCOME TO ANOTHER CITY ...................................................................... $ ________________

I

C. TOTAL CREDITS ........................................................................................................................................................................ $ ______________

O

11.

NET TAX DUE (LINE 9 LESS LINE 10C) ........................................................................................................................................ $ ______________

N

A. MINUS OVERPAYMENT FROM PRIOR YEAR (S) ................................................................................ $ ________________

IV

B. BALANCE OF ESTIMATED TAX DUE ........................................................................................................................................ $ ______________

12.

AMOUNT PAID WITH THIS DECLARATION (.25 OF LINE 11 MINUS 11A) .................................................................................. $

TOTAL

13.

AMOUNT ENCLOSED .............................. (LINE 7) $ ____________ ........................ (LINE 12) $ __________

$

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT

AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

ADDRESS AND TELEPHONE NUMBER

WHITE COPY TAX OFFICE

YELLOW COPY TAXPAYER’S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2