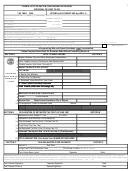

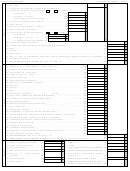

Form 480.20(I) - Corporation Of Individuals Informative Income Tax Return Page 3

ADVERTISEMENT

Form 480.20 (I) Rev. 03.99

Corporation of Individuals - Page 3

Compensation to stockholders or officers

Percentage of stocks or shares owned

Social Security

Percentage of time

Name of Stockholder

Compensation

Number

devoted to business

Common

Preferred

00

00

00

00

0 0

Total compensation to stockholders or officers (Enter on Part VI, line 16)

0 0

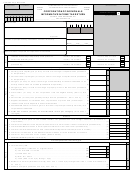

Comparative Balance Sheet

Beginning of the Year

Ending of the Year

Total

Total

Assets

00

0 0

1.

Cash on hands and in bank ...............

___________________________

______________________________

(1)

(1)

00

00

2.

Accounts receivable ..........................

___________________________

__________________________

(2)

(2)

(

)

(

)

00

00

00

00

3.

Less: Reserve for bad debts ..............

___________________________

___________________________

___________________________

(3)

(3)

00

00

4.

Notes receivable ...............................

___________________________

___________________________

(4)

(4)

00

00

5.

Inventories .......................................

___________________________

___________________________

(5)

(5)

00

00

6.

Investments ......................................

___________________________

___________________________

(6)

(6)

00

00

7.

Depreciable assets ...........................

___________________________

__________________________

(7)

(7)

(

)

(

)

00

00

00

00

8.

Less: Reserve for depreciation ..........

___________________________

___________________________

___________________________

(8)

(8)

00

00

9.

Land ................................................

___________________________

___________________________

(9)

(9)

00

00

10.

Other assets .....................................

___________________________

___________________________

(10)

(10)

00

00

11.

Total Assets ....................................

___________________________

___________________________

(11)

(11)

Liabilities and Stockholder's Equity

Liabilities

00

00

12.

Accounts payable .............................

______________________________

__________________________

(12)

(12)

00

00

13.

Notes payable ...................................

______________________________

__________________________

(13)

(13)

00

00

14.

Accrued expenses (not paid) ................

______________________________

__________________________

(14)

(14)

00

00

15.

Other liabilities ......................................

______________________________

__________________________

(15)

(15)

00

00

16.

Total Liabilities .....................................

___________________________

___________________________

(16)

(16)

Stockholder's Equity

17.

Capital stock

0 0

0 0

(a) Preferred stock.................................

______________________________

__________________________

(17a)

(17a)

0 0

0 0

(b) Common stock................................

______________________________

__________________________

(17b)

(17b)

0 0

0 0

18.

Additional Paid in Capital.....................

______________________________

__________________________

(18)

(18)

0 0

0 0

19.

Retained Earnings................................

______________________________

___________________________

(19)

(19)

0 0

0 0

20.

Reserve ..................................................

(20)

(20)

0 0

0 0

21.

Total Stockholder's Equity .................

______________________________

______________________________

(21)

(21)

0 0

0 0

22.

......

Total Liabilities and Stockholder's Equity

(22)

(22)

Reconciliation of Net Income (or Loss) per Books with Net Taxable Income ( or Loss) per Return

0 0

5.

Income recorded on books this year

1.

Net income per books ..........................

______________________________

(1)

not included on this return

2.

Taxable income not recorded on books

(a) Exempt interest ______________

this year (Itemize)

(b)

__________________________

____________________________

(a)

(c)

__________________________

____________________________

(b)

0 0

Total ................................................

____________________________

(c)

______________________________

(5)

0 0

6.

Deductions on this tax return not

Total ................................................

______________________________

(2)

charged against book income this year

3.

Expenses recorded on books this year

(a) Depreciation _________________

not claimed on this return

(b) ___________________________

Meal and entertainment (amount

(a)

(c) ___________________________

not claimed) _________________

0 0

Total ................................................

Depreciation _________________

(b)

______________________________

(6)

0 0

7.

Total (Add lines 5 and 6) ....................

____________________________

(c)

______________________________

(7)

0 0

8.

Net taxable income (or loss) per

Total ................................................

______________________________

(3)

0 0

0 0

return (Subtract line 7 from line 4) ....

4.

Total (Add lines 1 through 3) ..................

(8)

(4)

Analysis of Undistributed Profits per Books

0 0

0 0

5.

Distributions:

(a) Cash ..................

1.

Balance at beginning of the year .......

______________________________

______________________________

(5a)

(1)

0 0

0 0

(b) Property .............

2.

Net income per books .......................

______________________________

______________________________

(5b)

(2)

0 0

(c) Stocks ..................

3.

Other increases (Itemize, use schedule

______________________________

(5c)

0 0

6.

Other decreases (Itemize) ...................

if necessary)

______________________________

(6)

0 0

0 0

7.

Total (Add lines 5 and 6) ...................

_____________________________

(a)

______________________________

______________________________

(7)

(3a)

0 0

8.

Balance at end of the year (Subtract

_____________________________

(b)

______________________________

(3b)

0 0

0 0

line 7 from line 4) ...............................

4.

Total (Add lines 1, 2 and 3) .................

(8)

(4)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4