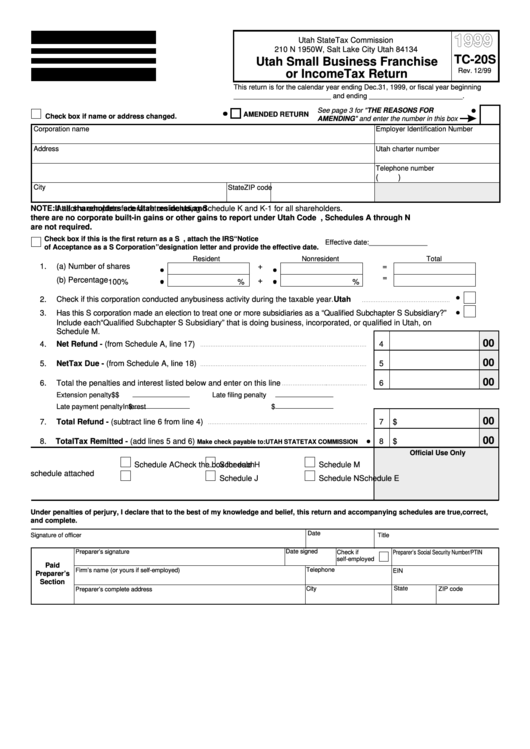

Form Tc-20s - Utah Small Business Franchise Or Income Tax Return - 1999

ADVERTISEMENT

1999

Utah State Tax Commission

210 N 1950 W, Salt Lake City Utah 84134

TC-20S

Utah Small Business Franchise

Rev. 12/99

or Income Tax Return

This return is for the calendar year ending Dec. 31, 1999, or fiscal year beginning

_________________________ and ending ________________________.

See page 3 for "

THE REASONS FOR

AMENDED RETURN

Check box if name or address changed.

AMENDING

" and enter the number in this box

Corporation name

Employer Identification Number

Address

Utah charter number

Telephone number

(

)

City

State

ZIP code

NOTE:

Attach a complete federal return including Schedule K and K-1 for all shareholders.

If all shareholders are Utah residents, and

there are no corporate built-in gains or other gains to report under Utah Code Ann. Section 59-7-701, Schedules A through N

are not required.

Check box if this is the first return as a S corporation. If so, attach the IRS “Notice

Effective date: _______________

of Acceptance as a S Corporation” designation letter and provide the effective date.

Resident

Nonresident

Total

1.

(a) Number of shares

+

=

=

(b) Percentage

+

%

%

100%

2.

Check if this corporation conducted any

Utah

business activity during the taxable year.

3.

Has this S corporation made an election to treat one or more subsidiaries as a “Qualified Subchapter S Subsidiary?”

Include each “Qualified Subchapter S Subsidiary” that is doing business, incorporated, or qualified in Utah, on

Schedule M.

00

4.

Net Refund - (from Schedule A, line 17)

4

00

5.

Net Tax Due - (from Schedule A, line 18)

5

00

6.

Total the penalties and interest listed below and enter on this line

6

Extension penalty

$

Late filing penalty

$

Late payment penalty

$

Interest

$

00

7.

Total Refund - (subtract line 6 from line 4)

7

$

00

8.

Total Tax Remitted - (add lines 5 and 6)

8

$

Make check payable to: UTAH STATE TAX COMMISSION

Official Use Only

Check the box for each

Schedule A

Schedule H

Schedule M

schedule attached

Schedule E

Schedule J

Schedule N

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and accompanying schedules are true, correct,

and complete.

Date

Signature of officer

Title

Preparer’s Social Security Number/PTIN

Date signed

Preparer’s signature

Check if

self-employed

Paid

Telephone

Firm’s name (or yours if self-employed)

EIN

Preparer’s

Section

City

State

ZIP code

Preparer’s complete address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2