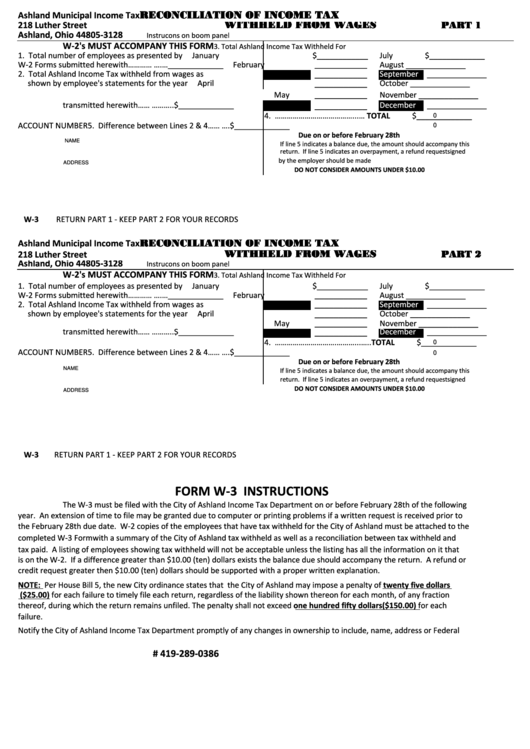

Form W-3 - Reconciliation Of Income Tax/instructions

ADVERTISEMENT

RECONCILIATION OF INCOME TAX

Ashland Municipal Income Tax

WITHHELD FROM WAGES

PART 1

218 Luther Street

Ashland, Ohio 44805-3128

Instructions on bottom panel

W-2's MUST ACCOMPANY THIS FORM

3. Total Ashland Income Tax Withheld For

1. Total number of employees as presented by

January

$____________

July

$_____________

___________

W-2 Forms submitted herewith………….....….…_____________

February

August

______________

___________

2. Total Ashland Income Tax withheld from wages as

March

September

______________

___________

shown by employee's statements for the year

April

October

______________

___________

May

November

______________

___________

transmitted herewith…….....………..$_____________

June

December

______________

4. …………………………………...….... TOTAL

$_____________

0

ACCOUNT NUMBER

5. Difference between Lines 2 & 4…….....….

$_____________

0

Due on or before February 28th

NAME

If line 5 indicates a balance due, the amount should accompany this

return. If line 5 indicates an overpayment, a refund requestsigned

by the employer should be made

ADDRESS

DO NOT CONSIDER AMOUNTS UNDER $10.00

W-3

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

RECONCILIATION OF INCOME TAX

Ashland Municipal Income Tax

WITHHELD FROM WAGES

PART 2

218 Luther Street

Ashland, Ohio 44805-3128

Instructions on bottom panel

W-2's MUST ACCOMPANY THIS FORM

3. Total Ashland Income Tax Withheld For

1. Total number of employees as presented by

January

$____________

July

$_____________

___________

W-2 Forms submitted herewith………….....….…_____________

February

August

______________

___________

2. Total Ashland Income Tax withheld from wages as

March

September

______________

___________

shown by employee's statements for the year

April

October

______________

___________

May

November

______________

___________

transmitted herewith…….....………..$_____________

June

December

______________

4. ………………………….………...….. TOTAL

$_____________

0

ACCOUNT NUMBER

5. Difference between Lines 2 & 4…….....….

$_____________

0

Due on or before February 28th

NAME

If line 5 indicates a balance due, the amount should accompany this

return. If line 5 indicates an overpayment, a refund requestsigned

DO NOT CONSIDER AMOUNTS UNDER $10.00

ADDRESS

W-3

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

FORM W-3 INSTRUCTIONS

The W-3 must be filed with the City of Ashland Income Tax Department on or before February 28th of the following

year. An extension of time to file may be granted due to computer or printing problems if a written request is received prior to

the February 28th due date. W-2 copies of the employees that have tax withheld for the City of Ashland must be attached to the

completed W-3 Formwith a summary of the City of Ashland tax withheld as well as a reconciliation between tax withheld and

tax paid. A listing of employees showing tax withheld will not be acceptable unless the listing has all the information on it that

is on the W-2. If a difference greater than $10.00 (ten) dollars exists the balance due should accompany the return. A refund or

credit request greater then $10.00 (ten) dollars should be supported with a proper written explanation.

NOTE: Per House Bill 5, the new City ordinance states that the City of Ashland may impose a penalty of twenty five dollars

($25.00) for each failure to timely file each return, regardless of the liability shown thereon for each month, of any fraction

thereof, during which the return remains unfiled. The penalty shall not exceed one hundred fifty dollars ($150.00) for each

failure.

Notify the City of Ashland Income Tax Department promptly of any changes in ownership to include, name, address or Federal

I.D.number

Phone # 419-289-0386

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1