Form Oic-1 - Offer In Compromise

Download a blank fillable Form Oic-1 - Offer In Compromise in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Oic-1 - Offer In Compromise with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Print

Clear

Save Form

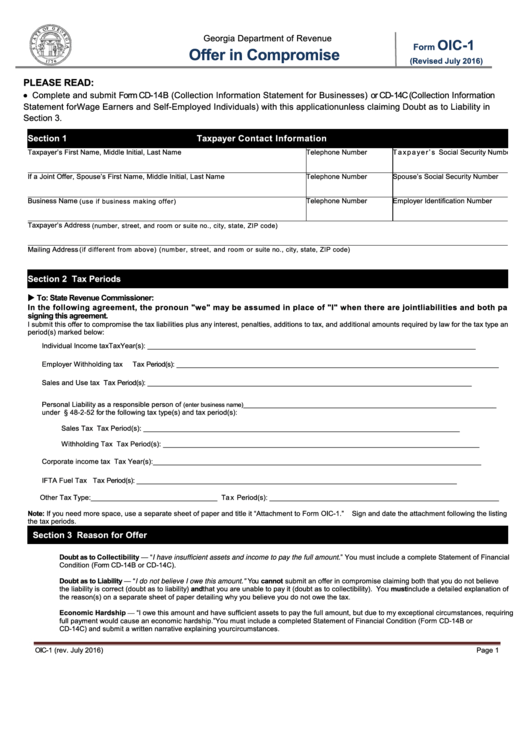

Georgia Department of Revenue

OIC-1

Form

Offer in Compromise

(Revised July 2016)

PLEASE READ:

• Complete and submit Form CD-14B (Collection Information Statement for Businesses) or CD-14C (Collection Information

Statement for Wage Earners and Self-Employed Individuals) with this application unless claiming Doubt as to Liability in

Section 3.

Section 1

Taxpayer Contact Information

Taxpayer’s First Name, Middle Initial, Last Name

Telephone Number

Taxpayer’s Social Security Number

If a Joint Offer, Spouse’s First Name, Middle Initial, Last Name

Telephone Number

Spouse’s Social Security Number

Business Name

Telephone Number

Employer Identification Number

(use if business making offer)

Taxpayer’s Address

(number, street, and room or suite no., city, state, ZIP code)

Mailing Address

(if different from above) (number, street, and room or suite no., city, state, ZIP code)

Section 2

Tax Periods

To: State Revenue Commissioner:

In the following agreement, the pronoun "we" may be assumed in place of "I" when there are joint liabilities and both parties are

signing this agreement.

I submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts required by law for the tax type and

period(s) marked below:

Individual Income tax

Tax Year(s): ___________________________________________________________________________________

Employer Withholding tax

Tax Period(s): __________________________________________________________________________________

Sales and Use tax

Tax Period(s): __________________________________________________________________________________

Personal Liability as a responsible person of

________________________________________________________________

(enter business name)

under O.C.G.A. § 48-2-52 for the following tax type(s) and tax period(s):

Sales Tax

Tax Period(s): ________________________________________________________________________________

Withholding Tax

Tax Period(s): ________________________________________________________________________________

Corporate income tax

Tax Year(s): ___________________________________________________________________________________

IFTA Fuel Tax

Tax Period(s): _________________________________________________________________________________

Other Tax Type: ________________________________ Tax Period(s): __________________________________________________________

Note: If you need more space, use a separate sheet of paper and title it “Attachment to Form OIC-1.”

Sign and date the attachment following the listing of

the tax periods.

Section 3

Reason for Offer

Doubt as to Collectibility — “I have insufficient assets and income to pay the full amount.” You must include a complete Statement of Financial

Condition (Form CD-14B or CD-14C).

Doubt as to Liability — “I do not believe I owe this amount.” You cannot submit an offer in compromise claiming both that you do not believe

the liability is correct (doubt as to liability) and that you are unable to pay it (doubt as to collectibility). You must include a detailed explanation of

the reason(s) on a separate sheet of paper detailing why you believe you do not owe the tax.

Economic Hardship — “I owe this amount and have sufficient assets to pay the full amount, but due to my exceptional circumstances, requiring

full payment would cause an economic hardship.” You must include a completed Statement of Financial Condition (Form CD-14B or

CD-14C) and submit a written narrative explaining your circumstances.

OIC-1 (rev. July 2016)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4