Wage Deduction Notice Form

Download a blank fillable Wage Deduction Notice Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Wage Deduction Notice Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

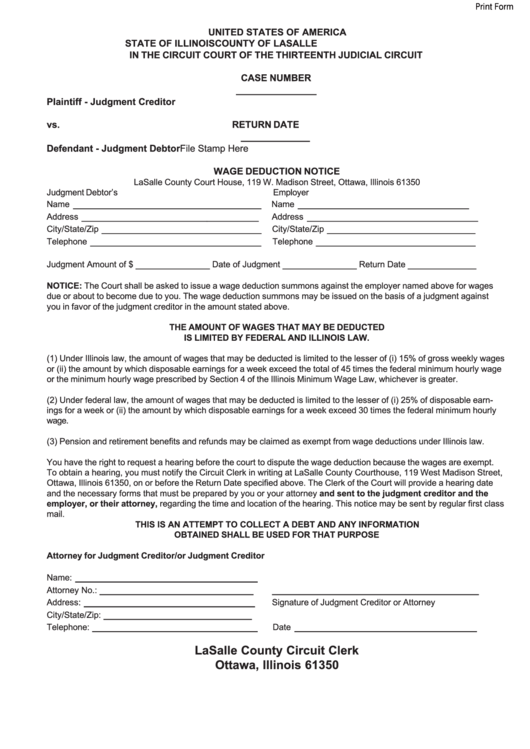

Print Form

UNITED STATES OF AMERICA

STATE OF ILLINOIS

COUNTY OF LASALLE

IN THE CIRCUIT COURT OF THE THIRTEENTH JUDICIAL CIRCUIT

CASE NUMBER

______________

Plaintiff - Judgment Creditor

vs.

RETURN DATE

____________

File Stamp Here

Defendant - Judgment Debtor

WAGE DEDUCTION NOTICE

LaSalle County Court House, 119 W. Madison Street, Ottawa, Illinois 61350

Judgment Debtor’s

Employer

_________________________________

______________________________

Name

Name

_______________________________

______________________________

Address

Address

____________________________

__________________________

City/State/Zip

City/State/Zip

______________________________

____________________________

Telephone

Telephone

_____________

_____________

____________

Judgment Amount of $

Date of Judgment

Return Date

NOTICE: The Court shall be asked to issue a wage deduction summons against the employer named above for wages

due or about to become due to you. The wage deduction summons may be issued on the basis of a judgment against

you in favor of the judgment creditor in the amount stated above.

THE AMOUNT OF WAGES THAT MAY BE DEDUCTED

IS LIMITED BY FEDERAL AND ILLINOIS LAW.

(1) Under Illinois law, the amount of wages that may be deducted is limited to the lesser of (i) 15% of gross weekly wages

or (ii) the amount by which disposable earnings for a week exceed the total of 45 times the federal minimum hourly wage

or the minimum hourly wage prescribed by Section 4 of the Illinois Minimum Wage Law, whichever is greater.

(2) Under federal law, the amount of wages that may be deducted is limited to the lesser of (i) 25% of disposable earn-

ings for a week or (ii) the amount by which disposable earnings for a week exceed 30 times the federal minimum hourly

wage.

(3) Pension and retirement benefits and refunds may be claimed as exempt from wage deductions under Illinois law.

You have the right to request a hearing before the court to dispute the wage deduction because the wages are exempt.

To obtain a hearing, you must notify the Circuit Clerk in writing at LaSalle County Courthouse, 119 West Madison Street,

Ottawa, Illinois 61350, on or before the Return Date specified above. The Clerk of the Court will provide a hearing date

and the necessary forms that must be prepared by you or your attorney and sent to the judgment creditor and the

employer, or their attorney, regarding the time and location of the hearing. This notice may be sent by regular first class

mail.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION

OBTAINED SHALL BE USED FOR THAT PURPOSE

Attorney for Judgment Creditor/or Judgment Creditor

________________________________

Name:

___________________________

____________________________________

Attorney No.:

______________________________

Address:

Signature of Judgment Creditor or Attorney

__________________________

City/State/Zip:

_____________________________

________________________________

Telephone:

Date

LaSalle County Circuit Clerk

Ottawa, Illinois 61350

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1