Tdlr Form 012 - Service Contract Providers Funded Reserve And Security Deposit Financial Security Calculation Form

ADVERTISEMENT

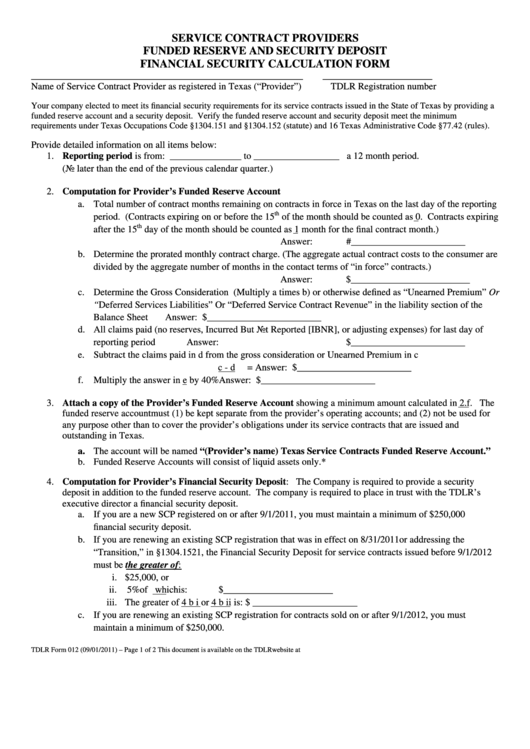

SERVICE CONTRACT PROVIDERS

FUNDED RESERVE AND SECURITY DEPOSIT

FINANCIAL SECURITY CALCULATION FORM

_________________________________________________________

_______________________

Name of Service Contract Provider as registered in Texas (“Provider”)

TDLR Registration number

Your company elected to meet its financial security requirements for its service contracts issued in the State of Texas by providing a

funded reserve account and a security deposit. Verify the funded reserve account and security deposit meet the minimum

requirements under Texas Occupations Code §1304.151 and §1304.152 (statute) and 16 Texas Administrative Code §77.42 (rules).

Provide detailed information on all items below:

1. Reporting period is from: _______________ to __________________ a 12 month period.

(No later than the end of the previous calendar quarter.)

2. Computation for Provider’s Funded Reserve Account

a. Total number of contract months remaining on contracts in force in Texas on the last day of the reporting

th

period. (Contracts expiring on or before the 15

of the month should be counted as 0. Contracts expiring

th

after the 15

day of the month should be counted as 1 month for the final contract month.)

Answer: #________________________

b. Determine the prorated monthly contract charge. (The aggregate actual contract costs to the consumer are

divided by the aggregate number of months in the contact terms of “in force” contracts.)

Answer: $_________________________

c. Determine the Gross Consideration (Multiply a times b) or otherwise defined as “Unearned Premium” Or

“Deferred Services Liabilities” Or “Deferred Service Contract Revenue” in the liability section of the

Balance Sheet

Answer: $________________________

d. All claims paid (no reserves, Incurred But Not Reported [IBNR], or adjusting expenses) for last day of

reporting period

Answer: $________________________

e. Subtract the claims paid in d from the gross consideration or Unearned Premium in c

c - d

=

Answer: $________________________

f.

Multiply the answer in e by 40%

Answer: $________________________

3. Attach a copy of the Provider’s Funded Reserve Account showing a minimum amount calculated in 2.f. The

funded reserve account must (1) be kept separate from the provider’s operating accounts; and (2) not be used for

any purpose other than to cover the provider’s obligations under its service contracts that are issued and

outstanding in Texas.

a. The account will be named “(Provider’s name) Texas Service Contracts Funded Reserve Account.”

b. Funded Reserve Accounts will consist of liquid assets only.*

4. Computation for Provider’s Financial Security Deposit: The Company is required to provide a security

deposit in addition to the funded reserve account. The company is required to place in trust with the TDLR’s

executive director a financial security deposit.

a. If you are a new SCP registered on or after 9/1/2011, you must maintain a minimum of $250,000

financial security deposit.

b. If you are renewing an existing SCP registration that was in effect on 8/31/2011or addressing the

“Transition,” in §1304.1521, the Financial Security Deposit for service contracts issued before 9/1/2012

must be the greater of:

i. $25,000, or

ii.

5% of 2.e. which is:

$_______________________

iii. The greater of 4 b i or 4 b ii is:

$ ______________________

c. If you are renewing an existing SCP registration for contracts sold on or after 9/1/2012, you must

maintain a minimum of $250,000.

TDLR Form 012 (09/01/2011) – Page 1 of 2

This document is available on the TDLR website at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2