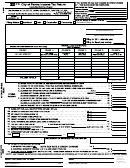

Mercantile Tax Return Form - 2016 Page 2

ADVERTISEMENT

(M)

PART “A” 2015 TAX REPORT

11. Estimated gross receipts for 2015 ........................................................................................................................ $ ___________________

12. Actual gross receipts for 2015 calendar year....................................................................................................... $ ___________________

PLEASE ATTACH APPROPRIATE COPY OF FEDERAL TAX FORM SUPPORTING GROSS RECEIPTS FIGURE

13. Less exclusions or exemptions (Ord. #850, Sec. 129.51 + .53)

Detailed supporting schedule must be attached to be valid.................................................................................($ __________________)

14. Total receipts upon which tax is payable ............................................................................................................. $ ___________________

15. Amount of tax due:

A. WHOLESALE

Gross Receipts $___________________ Tax 1 mill (.001) ........................................................................... $ ___________________

B. RETAIL

Gross Receipts $___________________ TAX 1

1

/

mills (.0015).................................................................. $ ___________________

2

C. TRADE RESALES

Gross Receipts $___________________ Tax 3/4 mill (.00075) .................................................................... $ ___________________

D. TOTAL TAX DUE FOR 2015 (line 5A, 5B & 5C)........................................................................................ $ ___________________

CREDITS

16. 2015 Estimated Tax payment (Do not include penalty and interest) Same as line #9D on 2015 tax form.......($ __________________)

17. Balance Due (or Credit) – line #5D minus line #6 for year ending December 31, 2015 ................................... $ ___________________

PART “B” 2016 TENTATIVE REPORT

18. Total estimated gross receipts. This figure should not be less than line #4 above

(if line #4 is not a 12 month figure, project a 12 month figure).......................................................................... $ ___________________

19. Total estimated tax due for 2016:

A. WHOLESALE

Gross Receipts $________________ Tax 1 mill (.001) ................................................................................. $ ___________________

B. RETAIL

1

Gross Receipts $________________ TAX 1

/

mills (.0015)........................................................................ $ ___________________

2

C. TRADE RESALES

Gross Receipts $________________ Tax 3/4 mill (.00075) .......................................................................... $ ___________________

D. TOTAL ESTIMATED TAX DUE FOR 2016 (line 9A, 9B & 9C) ................................................................ $ ___________________

10. Total Tax Due: (Add line #7 + line #9D. If line #7 is a credit, subtract from line #9D) ................................... $ ___________________

11. Penalty & Interest

(a) Penalty (10% of line #10 after June 1).......................................................................................................... $ ___________________

(b) Interest (1% per each month late of line #10 starting with June) ................................................................. $ ___________________

50.00

12.

LICENSE FEE

- 2016 - Fifty Dollars.............................................................................................................. $ ___________________

13. TOTAL TAX & LICENSE FEE DUE (line #10 + line #12, plus Penalty and Interest, if applicable)............... $ ___________________

.................................................................................................................................................................................

___________________

INSTRUCTIONS

1. Fiscal year taxpayers must submit a schedule converting activity to a calendar year. Consolidated or combined return filers must show

their 12 month gross receipts. (Jan.-Dec.) Computerized sales reports, manually prepared summaries and gross receipts portion of full

year profit and loss statements would be acceptable.

RETURN DUE

2. This form must be prepared in its entirety. If not applicable, so state. Extensions are not accepted.

MAY 31, 2016

3. If your business is subject to both Business Privilege and Mercantile Tax,

please send SEPARATE CHECKS for each amount due.

4. NOTE –

Federal excise taxes and the Pennsylvania Liquid Fuels Tax may be excluded from the gross

receipts, provided such taxes are separately stated on the evidence of charge or sale.

THIS RETURN MUST BE FILED EACH YEAR AND THE TAX/LICENSE PAID IN FULL ON OR BEFORE MAY 31. MAKE CHECK OR MONEY

ORDER PAYABLE TO: SPRINGFIELD TOWNSHIP.

MAIL TO: BUSINESS TAX OFFICE, 50 POWELL ROAD, SPRINGFIELD, PA 19064.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2