2015 Mercantile Tax Return Form - Borough Of Pitcairn

ADVERTISEMENT

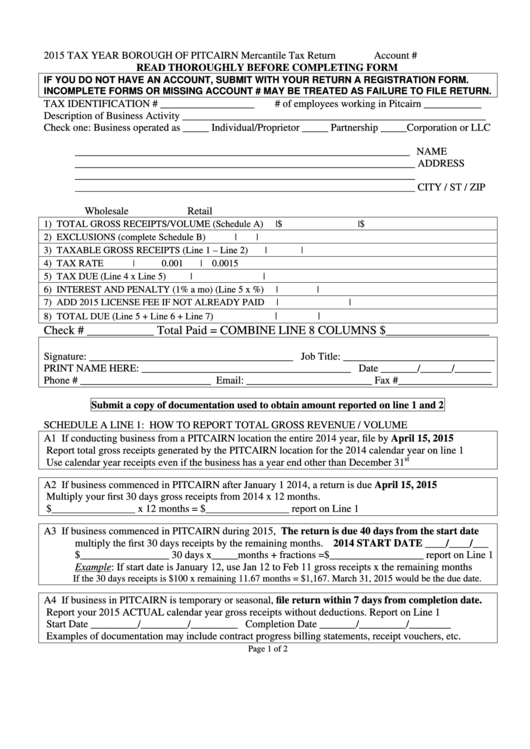

2015 TAX YEAR

BOROUGH OF PITCAIRN Mercantile Tax Return

Account #

READ THOROUGHLY BEFORE COMPLETING FORM

IF YOU DO NOT HAVE AN ACCOUNT, SUBMIT WITH YOUR RETURN A REGISTRATION FORM.

INCOMPLETE FORMS OR MISSING ACCOUNT # MAY BE TREATED AS FAILURE TO FILE RETURN.

TAX IDENTIFICATION # __________________

# of employees working in Pitcairn ___________

Description of Business Activity __________________________________________________________

Check one: Business operated as _____ Individual/Proprietor _____ Partnership _____Corporation or LLC

________________________________________________________________ NAME

_________________________________________________________________ ADDRESS

_________________________________________________________________

_________________________________________________________________ CITY / ST / ZIP

Wholesale

Retail

1) TOTAL GROSS RECEIPTS/VOLUME (Schedule A)

|$

|$

2) EXCLUSIONS (complete Schedule B)

|

|

3) TAXABLE GROSS RECEIPTS (Line 1 – Line 2)

|

|

4) TAX RATE

|

0.001

|

0.0015

5) TAX DUE (Line 4 x Line 5)

|

|

6) INTEREST AND PENALTY (1% a mo) (Line 5 x %)

|

|

7) ADD 2015 LICENSE FEE IF NOT ALREADY PAID

|

|

|

|

8) TOTAL DUE (Line 5 + Line 6 + Line 7)

Check # ___________ Total Paid = COMBINE LINE 8 COLUMNS $_________________

Signature: _______________________________________ Job Title: _____________________________

PRINT NAME HERE: ________________________________________ Date _______/______/_______

Phone # _________________________ Email: ________________________ Fax #__________________

Submit a copy of documentation used to obtain amount reported on line 1 and 2

SCHEDULE A LINE 1:

HOW TO REPORT TOTAL GROSS REVENUE / VOLUME

A1 If conducting business from a PITCAIRN location the entire 2014 year, file by April 15, 2015

Report total gross receipts generated by the PITCAIRN location for the 2014 calendar year on line 1

st

Use calendar year receipts even if the business has a year end other than December 31

A2 If business commenced in PITCAIRN after January 1 2014, a return is due April 15, 2015

Multiply your first 30 days gross receipts from 2014 x 12 months.

$________________ x 12 months = $________________ report on Line 1

A3 If business commenced in PITCAIRN during 2015,

The return is due 40 days from the start date

multiply the first 30 days receipts by the remaining months. 2014 START DATE ____/____/___

$_________________ 30 days x_____months + fractions =$__________________ report on Line 1

Example: If start date is January 12, use Jan 12 to Feb 11 gross receipts x the remaining months

If the 30 days receipts is $100 x remaining 11.67 months = $1,167. March 31, 2015 would be the due date.

A4 If business in PITCAIRN is temporary or seasonal, file return within 7 days from completion date.

Report your 2015 ACTUAL calendar year gross receipts without deductions. Report on Line 1

Start Date _________/_________/_________ Completion Date _______/_________/________

Examples of documentation may include contract progress billing statements, receipt vouchers, etc.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2