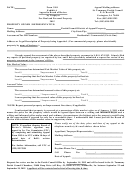

Form 618, Page 2

FOR BOARD OF REVIEW USE ONLY

INSTRUCTIONS: Incorporate a copy of this form and the assigned number in the Board of Review minutes.

Petition Number

Parcel Code

1. ASSESSED VALUE

Disposition by Board of Review. The Board of Review must state the reason for its action below.

Denied

Assessed Value Changed From ______________________ to ____________________________

Record of vote - Board or three member committee of board

Chairperson:

Member:

Member:

Yes

No

Yes

No

Yes

No

Initials

Initials

Initials

Reason for board action

If you disagree with the decision of the Board of Review regarding tentative assessed value, you may appeal that decision by filing a petition with the

Michigan Tax Tribunal at P.O. Box 30232, Lansing, MI 48909. Commercial Real, Industrial Real, Developmental Real, Commercial Personal,

Industrial Personal and Utility Personal Property may be appealed by May 31. Agricultural Real, Residential Real, Timber-Cutover Real and Agricultural

Personal Property may be appealed by July 31. The petition must be filed on a Michigan Tax Tribunal form or a form approved by the Michigan Tax

Tribunal. Michigan Tax Tribunal forms are available at

2. TENTATIVE TAXABLE VALUE

Disposition by Board of Review. The Board of Review must state the reason for its action below.

Denied

Tentative Taxable Value Changed From ___________________ to ________________________

Record of vote - Board or three member committee of board

Chairperson:

Member:

Member:

Yes

No

Yes

No

Yes

No

Initials

Initials

Initials

Reason for board action

If you disagree with the decision of the Board of Review regarding tentative taxable value, you may appeal that decision by filing a petition with the

Michigan Tax Tribunal at P.O. Box 30232, Lansing, MI 48909. Commercial Real, Industrial Real, Developmental Real, Commercial Personal,

Industrial Personal and Utility Personal Property may be appealed by May 31. Agricultural Real, Residential Real, Timber-Cutover Real and

Agricultural Personal Property may be appealed by July 31. The petition must be filed on a Michigan Tax Tribunal form or a form approved by the

Michigan Tax Tribunal. Michigan Tax Tribunal forms are available at

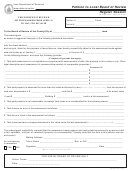

3. CLASSIFICATION

Disposition by Board of Review. The Board of Review must state the reason for its action below.

Denied

Classification Changed From ______________________ to ____________________________

Record of vote - Board or three member committee of board

Chairperson:

Member:

Member:

Yes

No

Yes

No

Yes

No

Initials

Initials

Initials

Reason for board action

If you disagree with the decision of the Board of Review regarding classification, you may appeal by sending Form 2167 to the State Tax Commission

at P.O. Box 30471, Lansing, MI 48909 by June 30.

4. QUALIFIED AGRICULTURAL PROPERTY EXEMPTION

Disposition by Board of Review. The Board of Review must state the reason for its action below.

Exemption Request Denied

Exemption percent modified from _____________% to _____________%

Record of vote - Board or three member committee of board

Chairperson:

Member:

Member:

Yes

No

Yes

No

Yes

No

Initials

Initials

Initials

Reason for board action

If you disagree with the decision of the Board of Review regarding tentative taxable value, you may appeal that decision by filing a petition with the

Michigan Tax Tribunal at P.O. Box 30232, Lansing, MI 48909 by July 31. The petition must be filed on a Michigan Tax Tribunal form or a form

approved by the Michigan Tax Tribunal. Michigan Tax Tribunal forms are available at

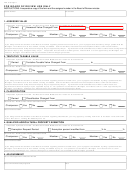

5. ADJOURNMENT

Date of Final adjournment of Board of Review

Board of Review Secretary Signature

Date

1

1 2

2