Form Dor 82104 Senior Property Valuation Protection Option With Instructions - 2003

ADVERTISEMENT

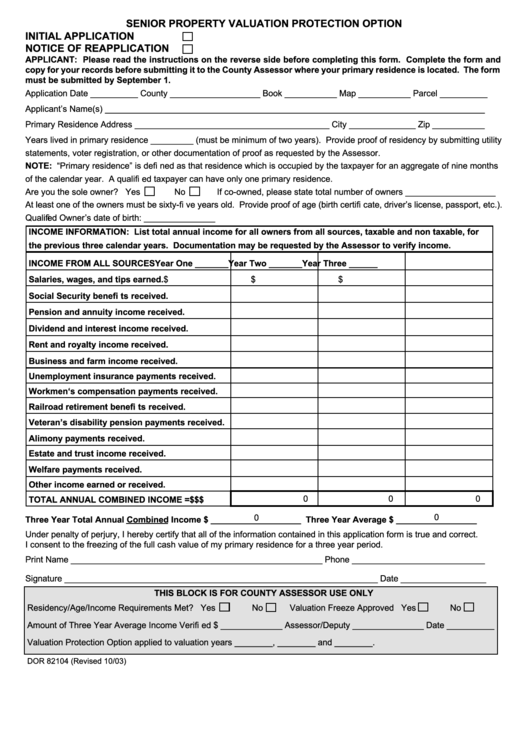

SENIOR PROPERTY VALUATION PROTECTION OPTION

INITIAL APPLICATION

NOTICE OF REAPPLICATION

APPLICANT: Please read the instructions on the reverse side before completing this form. Complete the form and

copy for your records before submitting it to the County Assessor where your primary residence is located. The form

must be submitted by September 1.

Application Date __________ County ___________________ Book ___________ Map ___________ Parcel __________

Applicant’s Name(s) ________________________________________________________________________________

Primary Residence Address _________________________________________ City ______________ Zip ___________

Years lived in primary residence _________ (must be minimum of two years). Provide proof of residency by submitting utility

statements, voter registration, or other documentation of proof as requested by the Assessor.

NOTE: “Primary residence” is defi ned as that residence which is occupied by the taxpayer for an aggregate of nine months

of the calendar year. A qualifi ed taxpayer can have only one primary residence.

Are you the sole owner? Yes

No

If co-owned, please state total number of owners ___________________

At least one of the owners must be sixty-fi ve years old. Provide proof of age (birth certifi cate, driver’s license, passport, etc.).

Qualifi ed Owner’s date of birth: _______________

INCOME INFORMATION: List total annual income for all owners from all sources, taxable and non taxable, for

the previous three calendar years. Documentation may be requested by the Assessor to verify income.

INCOME FROM ALL SOURCES

Year One _______

Year Two _______

Year Three ______

Salaries, wages, and tips earned.

$

$

$

Social Security benefi ts received.

Pension and annuity income received.

Dividend and interest income received.

Rent and royalty income received.

Business and farm income received.

Unemployment insurance payments received.

Workmen‘s compensation payments received.

Railroad retirement benefi ts received.

Veteran’s disability pension payments received.

Alimony payments received.

Estate and trust income received.

Welfare payments received.

Other income earned or received.

0

0

0

TOTAL ANNUAL COMBINED INCOME =

$

$

$

0

0

Three Year Total Annual Combined Income $ ___________________ Three Year Average $ _________________

Under penalty of perjury, I hereby certify that all of the information contained in this application form is true and correct.

I consent to the freezing of the full cash value of my primary residence for a three year period.

Print Name _____________________________________________________ Phone ____________________________

Signature __________________________________________________________________ Date __________________

THIS BLOCK IS FOR COUNTY ASSESSOR USE ONLY

Residency/Age/Income Requirements Met? Yes

No

Valuation Freeze Approved Yes

No

Amount of Three Year Average Income Verifi ed $ _____________ Assessor/Deputy _______________ Date __________

Valuation Protection Option applied to valuation years ________, ________ and ________.

DOR 82104 (Revised 10/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2