Print

Clear Form

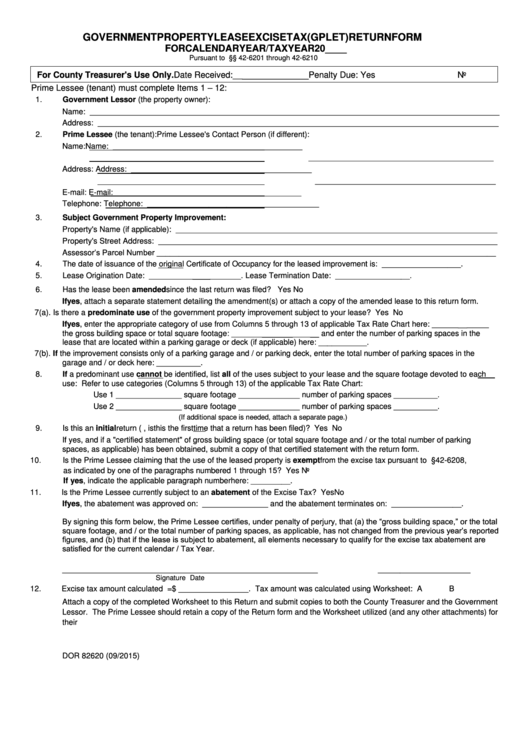

GOVERNMENT PROPERTY LEASE EXCISE TAX (GPLET) RETURN FORM

FOR CALENDAR YEAR / TAX YEAR 20____

Pursuant to A.R.S. §§ 42-6201 through 42-6210

For County Treasurer's Use Only.

Date Received:________________ Penalty Due: Yes

No

Prime Lessee (tenant) must complete Items 1 – 12:

1.

Government Lessor (the property owner):

Name: _____________________________________________________________________________________________

Address: ___________________________________________________________________________________________

2.

Prime Lessee (the tenant):

Prime Lessee's Contact Person (if different):

Name:

Name: ___________________________________________

__________________________________________

Address:

Address: _________________________________________

_________________________________________

E-mail:

E-mail: __________________________________________

Telephone:

Telephone: _______________________________________

3.

Subject Government Property Improvement:

Property's Name (if applicable): _________________________________________________________________________

Property's Street Address: _____________________________________________________________________________

Assessor’s Parcel Number _____________________________________________________________________________

4.

The date of issuance of the original Certificate of Occupancy for the leased improvement is: __________________.

5.

Lease Origination Date: _____________________.

Lease Termination Date: _________________.

6.

Has the lease been amended since the last return was filed? Yes

No

If yes, attach a separate statement detailing the amendment(s) or attach a copy of the amended lease to this return form.

7(a).

Is there a predominate use of the government property improvement subject to your lease? Yes

No

If yes, enter the appropriate category of use from Columns 5 through 13 of applicable Tax Rate Chart here: _____________

the gross building space or total square footage: ____________________ and enter the number of parking spaces in the

lease that are located within a parking garage or deck (if applicable) here: ___________.

7(b).

If the improvement consists only of a parking garage and / or parking deck, enter the total number of parking spaces in the

garage and / or deck here: __________.

8.

If a predominant use cannot be identified, list all of the uses subject to your lease and the square footage devoted to each

use: Refer to use categories (Columns 5 through 13) of the applicable Tax Rate Chart:

Use 1 _______________ square footage ______________ number of parking spaces __________.

Use 2 _______________ square footage ______________ number of parking spaces __________.

(If additional space is needed, attach a separate page.)

9.

Is this an initial return (i.e., is this the first time that a return has been filed)? Yes

No

If yes, and if a "certified statement" of gross building space (or total square footage and / or the total number of parking

spaces, as applicable) has been obtained, submit a copy of that certified statement with the return form.

Is the Prime Lessee claiming that the use of the leased property is exempt from the excise tax pursuant to A.R.S. § 42-6208,

10.

as indicated by one of the paragraphs numbered 1 through 15? Yes

No

If yes, indicate the applicable paragraph number here: _________.

11.

Is the Prime Lessee currently subject to an abatement of the Excise Tax? Yes

No

If yes, the abatement was approved on: _______________ and the abatement terminates on: ________________.

By signing this form below, the Prime Lessee certifies, under penalty of perjury, that (a) the “gross building space,” or the total

square footage, and / or the total number of parking spaces, as applicable, has not changed from the previous year’s reported

figures, and (b) that if the lease is subject to abatement, all elements necessary to qualify for the excise tax abatement are

satisfied for the current calendar / Tax Year.

__________________________________________________________

_____________________

Signature

Date

12.

Excise tax amount calculated = $ ________________. Tax amount was calculated using Worksheet: A

B

Attach a copy of the completed Worksheet to this Return and submit copies to both the County Treasurer and the Government

Lessor. The Prime Lessee should retain a copy of the Return form and the Worksheet utilized (and any other attachments) for

their records. The tax is due and payable to the County Treasurer on or before December 1 of each calendar year.

DOR 82620 (09/2015)

1

1