Form F-1193t - Notice Of Intent To Transfer A Florida Energy Tax Credit

ADVERTISEMENT

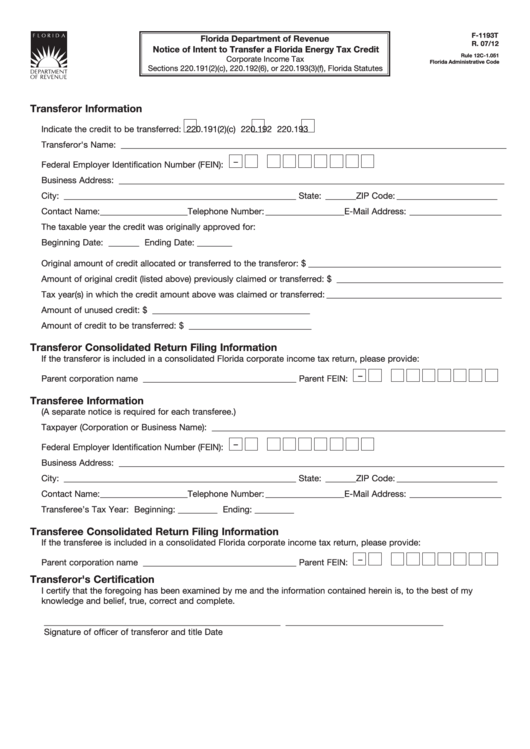

F-1193T

Florida Department of Revenue

R. 07/12

Notice of Intent to Transfer a Florida Energy Tax Credit

Rule 12C-1.051

Corporate Income Tax

Florida Administrative Code

Sections 220.191(2)(c), 220.192(6), or 220.193(3)(f), Florida Statutes

Transferor Information

Indicate the credit to be transferred:

220.191(2)(c)

220.192

220.193

Transferor's Name: ________________________________________________________________________________________

–

Federal Employer Identification Number (FEIN):

Business Address: ________________________________________________________________________________________

City: _____________________________________________________ State: _______ ZIP Code: _______________________

Contact Name: ____________________ Telephone Number: __________________E-Mail Address: _____________________

The taxable year the credit was originally approved for:

Beginning Date: _______ Ending Date: ________

Original amount of credit allocated or transferred to the transferor: $ ____________________________________________

Amount of original credit (listed above) previously claimed or transferred: $ ______________________________________

Tax year(s) in which the credit amount above was claimed or transferred: ________________________________________

Amount of unused credit: $ ____________________________________

Amount of credit to be transferred: $ ____________________________

Transferor Consolidated Return Filing Information

If the transferor is included in a consolidated Florida corporate income tax return, please provide:

–

Parent corporation name ___________________________________ Parent FEIN:

Transferee Information

(A separate notice is required for each transferee.)

Taxpayer (Corporation or Business Name): ___________________________________________________________________

–

Federal Employer Identification Number (FEIN):

Business Address: ________________________________________________________________________________________

City: _____________________________________________________ State: _______ ZIP Code: _______________________

Contact Name: ____________________ Telephone Number: __________________E-Mail Address: _____________________

Transferee’s Tax Year: Beginning: _________ Ending: _________

Transferee Consolidated Return Filing Information

If the transferee is included in a consolidated Florida corporate income tax return, please provide:

–

Parent corporation name ___________________________________ Parent FEIN:

Transferor's Certification

I certify that the foregoing has been examined by me and the information contained herein is, to the best of my

knowledge and belief, true, correct and complete.

______________________________________________________

____________________________________

Signature of officer of transferor and title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1