Form Dr-116200 - Florida Tax Credit Scholarship Program Notice Of Intent To Transfer A Tax Credit

ADVERTISEMENT

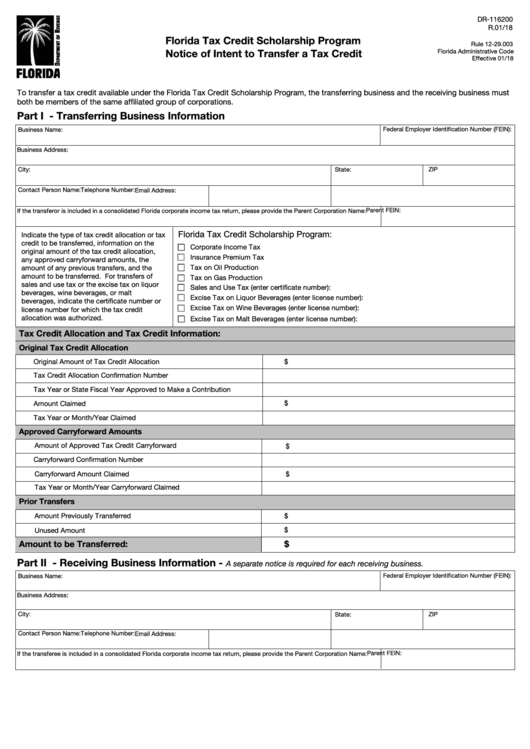

DR-116200

R.01/18

TC

Florida Tax Credit Scholarship Program

Rule 12-29.003

Florida Administrative Code

Notice of Intent to Transfer a Tax Credit

Effective 01/18

To transfer a tax credit available under the Florida Tax Credit Scholarship Program, the transferring business and the receiving business must

both be members of the same affiliated group of corporations.

Part I - Transferring Business Information

Federal Employer Identification Number (FEIN):

Business Name:

Business Address:

City:

State:

ZIP

Contact Person Name:

Telephone Number:

Email Address:

Parent FEIN:

If the transferor is included in a consolidated Florida corporate income tax return, please provide the Parent Corporation Name:

Florida Tax Credit Scholarship Program:

Indicate the type of tax credit allocation or tax

credit to be transferred, information on the

Corporate Income Tax

original amount of the tax credit allocation,

Insurance Premium Tax

any approved carryforward amounts, the

Tax on Oil Production

amount of any previous transfers, and the

amount to be transferred. For transfers of

Tax on Gas Production

sales and use tax or the excise tax on liquor

Sales and Use Tax (enter certificate number):

beverages, wine beverages, or malt

Excise Tax on Liquor Beverages (enter license number):

beverages, indicate the certificate number or

Excise Tax on Wine Beverages (enter license number):

license number for which the tax credit

allocation was authorized.

Excise Tax on Malt Beverages (enter license number):

Tax Credit Allocation and Tax Credit Information:

Original Tax Credit Allocation

Original Amount of Tax Credit Allocation

$

Tax Credit Allocation Confirmation Number

Tax Year or State Fiscal Year Approved to Make a Contribution

Amount Claimed

$

Tax Year or Month/Year Claimed

Approved Carryforward Amounts

Amount of Approved Tax Credit Carryforward

$

Carryforward Confirmation Number

Carryforward Amount Claimed

$

Tax Year or Month/Year Carryforward Claimed

Prior Transfers

Amount Previously Transferred

$

$

Unused Amount

Amount to be Transferred:

$

Part II - Receiving Business Information -

A separate notice is required for each receiving business.

Federal Employer Identification Number (FEIN):

Business Name:

Business Address:

ZIP

City:

State:

Contact Person Name:

Telephone Number:

Email Address:

Parent FEIN:

If the transferee is included in a consolidated Florida corporate income tax return, please provide the Parent Corporation Name:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2