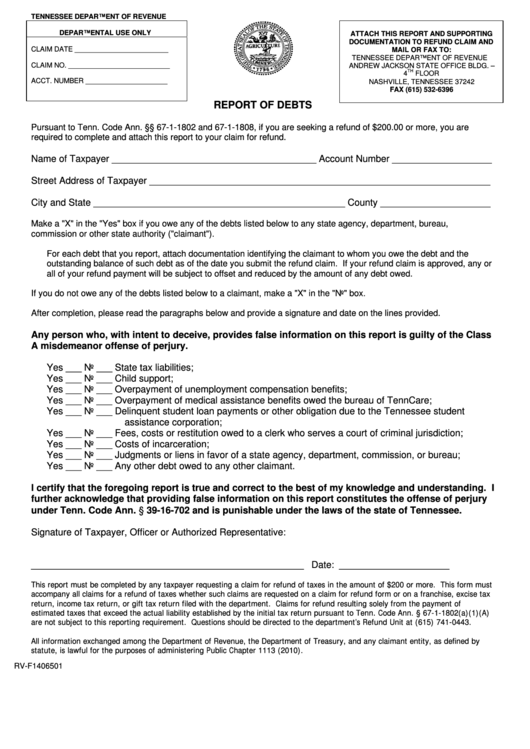

Form 1406501 - Report Of Debts 2002

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

DEPARTMENTAL USE ONLY

ATTACH THIS REPORT AND SUPPORTING

DOCUMENTATION TO REFUND CLAIM AND

CLAIM DATE ________________________

MAIL OR FAX TO:

TENNESSEE DEPARTMENT OF REVENUE

CLAIM NO. __________________________

ANDREW JACKSON STATE OFFICE BLDG. –

TH

4

FLOOR

ACCT. NUMBER _____________________

NASHVILLE, TENNESSEE 37242

FAX (615) 532-6396

REPORT OF DEBTS

Pursuant to Tenn. Code Ann. §§ 67-1-1802 and 67-1-1808, if you are seeking a refund of $200.00 or more, you are

required to complete and attach this report to your claim for refund.

Name of Taxpayer _______________________________________ Account Number ___________________

Street Address of Taxpayer _________________________________________________________________

City and State ________________________________________________ County _____________________

Make a "X" in the "Yes" box if you owe any of the debts listed below to any state agency, department, bureau,

commission or other state authority ("claimant").

For each debt that you report, attach documentation identifying the claimant to whom you owe the debt and the

outstanding balance of such debt as of the date you submit the refund claim. If your refund claim is approved, any or

all of your refund payment will be subject to offset and reduced by the amount of any debt owed.

If you do not owe any of the debts listed below to a claimant, make a "X" in the "No" box.

After completion, please read the paragraphs below and provide a signature and date on the lines provided.

Any person who, with intent to deceive, provides false information on this report is guilty of the Class

A misdemeanor offense of perjury.

Yes ___ No ___ State tax liabilities;

Yes ___ No ___ Child support;

Yes ___ No ___ Overpayment of unemployment compensation benefits;

Yes ___ No ___ Overpayment of medical assistance benefits owed the bureau of TennCare;

Yes ___ No ___ Delinquent student loan payments or other obligation due to the Tennessee student

assistance corporation;

Yes ___ No ___ Fees, costs or restitution owed to a clerk who serves a court of criminal jurisdiction;

Yes ___ No ___ Costs of incarceration;

Yes ___ No ___ Judgments or liens in favor of a state agency, department, commission, or bureau;

Yes ___ No ___ Any other debt owed to any other claimant.

I certify that the foregoing report is true and correct to the best of my knowledge and understanding. I

further acknowledge that providing false information on this report constitutes the offense of perjury

under Tenn. Code Ann. § 39-16-702 and is punishable under the laws of the state of Tennessee.

Signature of Taxpayer, Officer or Authorized Representative:

____________________________________________________

Date: _____________________

This report must be completed by any taxpayer requesting a claim for refund of taxes in the amount of $200 or more. This form must

accompany all claims for a refund of taxes whether such claims are requested on a claim for refund form or on a franchise, excise tax

return, income tax return, or gift tax return filed with the department. Claims for refund resulting solely from the payment of

estimated taxes that exceed the actual liability established by the initial tax return pursuant to Tenn. Code Ann. § 67-1-1802(a)(1)(A)

are not subject to this reporting requirement. Questions should be directed to the department’s Refund Unit at (615) 741-0443.

All information exchanged among the Department of Revenue, the Department of Treasury, and any claimant entity, as defined by

statute, is lawful for the purposes of administering Public Chapter 1113 (2010).

RV-F1406501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1