Print

Clear

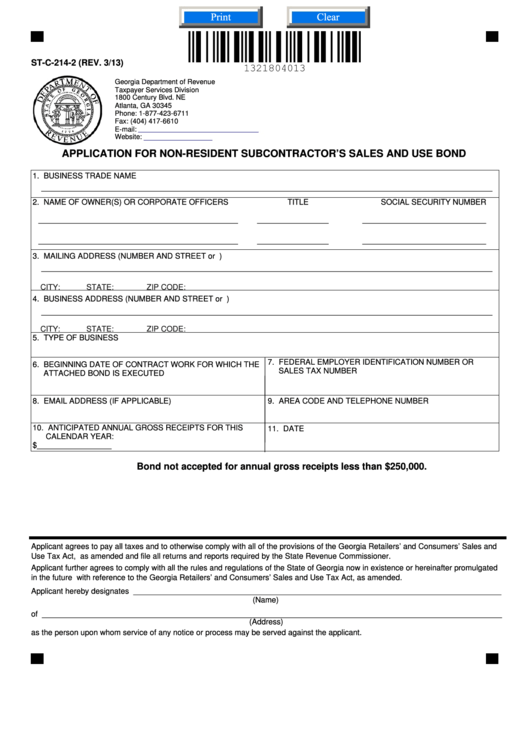

ST-C-214-2 (REV. 3/13)

Georgia Department of Revenue

Taxpayer Services Division

1800 Century Blvd. NE

Atlanta, GA 30345

Phone: 1-877-423-6711

Fax: (404) 417-6610

E-mail:

TSD-sales-tax-contractors@dor.ga.gov

Website:

https://etax.dor.ga.gov

APPLICATION FOR NON-RESIDENT SUBCONTRACTOR’S SALES AND USE BOND

1. BUSINESS TRADE NAME

_______________________________________________________________________________________________

2. NAME OF OWNER(S) OR CORPORATE OFFICERS

TITLE

SOCIAL SECURITY NUMBER

__________________________________________

_______________

__________________________

__________________________________________

_______________

__________________________

3. MAILING ADDRESS (NUMBER AND STREET or P.O. BOX)

_______________________________________________________________________________________________

CITY:

STATE:

ZIP CODE:

4. BUSINESS ADDRESS (NUMBER AND STREET or P.O. BOX)

_______________________________________________________________________________________________

CITY:

STATE:

ZIP CODE:

5. TYPE OF BUSINESS

7. FEDERAL EMPLOYER IDENTIFICATION NUMBER OR

6. BEGINNING DATE OF CONTRACT WORK FOR WHICH THE

SALES TAX NUMBER

ATTACHED BOND IS EXECUTED

8. EMAIL ADDRESS (IF APPLICABLE)

9. AREA CODE AND TELEPHONE NUMBER

10. ANTICIPATED ANNUAL GROSS RECEIPTS FOR THIS

11. DATE

CALENDAR YEAR:

$_________________

Bond not accepted for annual gross receipts less than $250,000.

Applicant agrees to pay all taxes and to otherwise comply with all of the provisions of the Georgia Retailers’ and Consumers’ Sales and

Use Tax Act, as amended and file all returns and reports required by the State Revenue Commissioner.

Applicant further agrees to comply with all the rules and regulations of the State of Georgia now in existence or hereinafter promulgated

in the future with reference to the Georgia Retailers’ and Consumers’ Sales and Use Tax Act, as amended.

Applicant hereby designates ____________________________________________________________________________________

(Name)

of _________________________________________________________________________________________________________

(Address)

as the person upon whom service of any notice or process may be served against the applicant.

1

1