Form Ctciv166/cociv51 - Instructions To Garnishee (Employer) - Nonsupport Payments - Answer Of Garnishee - Certificate Of Service - Garnishment Accounting Sheet

ADVERTISEMENT

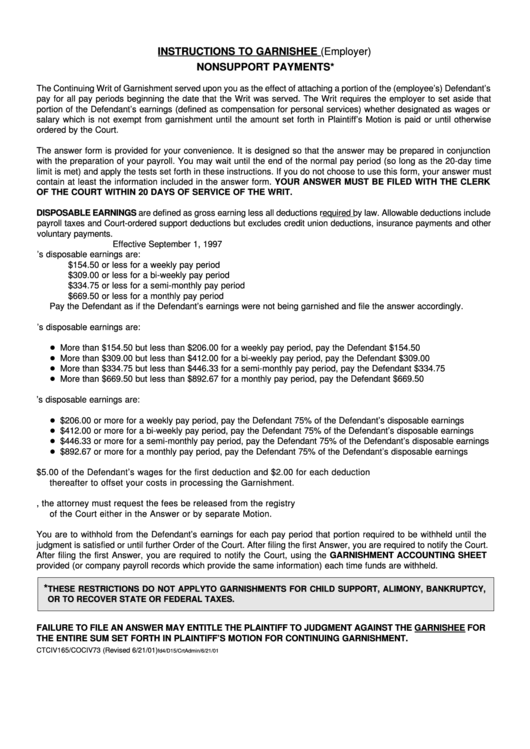

INSTRUCTIONS TO GARNISHEE (Employer)

NONSUPPORT PAYMENTS*

The Continuing Writ of Garnishment served upon you as the effect of attaching a portion of the (employee’s) Defendant’s

pay for all pay periods beginning the date that the Writ was served. The Writ requires the employer to set aside that

portion of the Defendant’s earnings (defined as compensation for personal services) whether designated as wages or

salary which is not exempt from garnishment until the amount set forth in Plaintiff’s Motion is paid or until otherwise

ordered by the Court.

The answer form is provided for your convenience. It is designed so that the answer may be prepared in conjunction

with the preparation of your payroll. You may wait until the end of the normal pay period (so long as the 20-day time

limit is met) and apply the tests set forth in these instructions. If you do not choose to use this form, your answer must

contain at least the information included in the answer form. YOUR ANSWER MUST BE FILED WITH THE CLERK

OF THE COURT WITHIN 20 DAYS OF SERVICE OF THE WRIT.

DISPOSABLE EARNINGS are defined as gross earning less all deductions required by law. Allowable deductions include

payroll taxes and Court-ordered support deductions but excludes credit union deductions, insurance payments and other

voluntary payments.

Effective September 1, 1997

1. If the Defendant’s disposable earnings are:

$154.50 or less for a weekly pay period

$309.00 or less for a bi-weekly pay period

$334.75 or less for a semi-monthly pay period

$669.50 or less for a monthly pay period

Pay the Defendant as if the Defendant’s earnings were not being garnished and file the answer accordingly.

2. If the Defendant’s disposable earnings are:

! More than $154.50 but less than $206.00 for a weekly pay period, pay the Defendant $154.50

! More than $309.00 but less than $412.00 for a bi-weekly pay period, pay the Defendant $309.00

! More than $334.75 but less than $446.33 for a semi-monthly pay period, pay the Defendant $334.75

! More than $669.50 but less than $892.67 for a monthly pay period, pay the Defendant $669.50

3. If the Defendant’s disposable earnings are:

! $206.00 or more for a weekly pay period, pay the Defendant 75% of the Defendant’s disposable earnings

! $412.00 or more for a bi-weekly pay period, pay the Defendant 75% of the Defendant’s disposable earnings

! $446.33 or more for a semi-monthly pay period, pay the Defendant 75% of the Defendant’s disposable earnings

! $892.67 or more for a monthly pay period, pay the Defendant 75% of the Defendant’s disposable earnings

4. You may ask the Court for $5.00 of the Defendant’s wages for the first deduction and $2.00 for each deduction

thereafter to offset your costs in processing the Garnishment.

5. If the Garnishment is answered by an attorney, the attorney must request the fees be released from the registry

of the Court either in the Answer or by separate Motion.

You are to withhold from the Defendant’s earnings for each pay period that portion required to be withheld until the

judgment is satisfied or until further Order of the Court. After filing the first Answer, you are required to notify the Court.

After filing the first Answer, you are required to notify the Court, using the GARNISHMENT ACCOUNTING SHEET

provided (or company payroll records which provide the same information) each time funds are withheld.

*

THESE RESTRICTIONS DO NOT APPLY TO GARNISHMENTS FOR CHILD SUPPORT, ALIMONY, BANKRUPTCY,

OR TO RECOVER STATE OR FEDERAL TAXES.

FAILURE TO FILE AN ANSWER MAY ENTITLE THE PLAINTIFF TO JUDGMENT AGAINST THE GARNISHEE FOR

THE ENTIRE SUM SET FORTH IN PLAINTIFF’S MOTION FOR CONTINUING GARNISHMENT.

CTCIV165/COCIV73 (Revised 6/21/01)

fd4/D15/CrtAdmin/6/21/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4