Form St-7 - Instructions To Vendors Concerning Use Of Farmer'S Exemption Certificate - St-7

ADVERTISEMENT

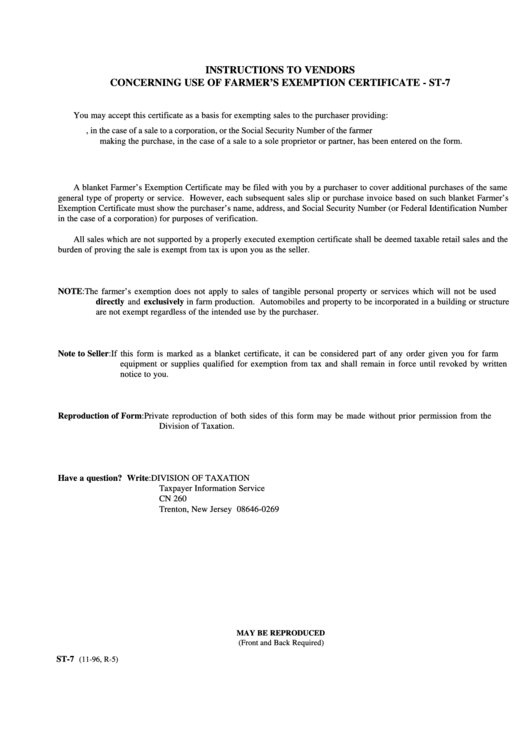

INSTRUCTIONS TO VENDORS

CONCERNING USE OF FARMER’S EXEMPTION CERTIFICATE - ST-7

You may accept this certificate as a basis for exempting sales to the purchaser providing:

a. The Federal Identification Number, in the case of a sale to a corporation, or the Social Security Number of the farmer

making the purchase, in the case of a sale to a sole proprietor or partner, has been entered on the form.

b. The purchaser has entered all other information required and checked the appropriate items.

A blanket Farmer’s Exemption Certificate may be filed with you by a purchaser to cover additional purchases of the same

general type of property or service. However, each subsequent sales slip or purchase invoice based on such blanket Farmer’s

Exemption Certificate must show the purchaser’s name, address, and Social Security Number (or Federal Identification Number

in the case of a corporation) for purposes of verification.

All sales which are not supported by a properly executed exemption certificate shall be deemed taxable retail sales and the

burden of proving the sale is exempt from tax is upon you as the seller.

NOTE:

The farmer’s exemption does not apply to sales of tangible personal property or services which will not be used

directly and exclusively in farm production. Automobiles and property to be incorporated in a building or structure

are not exempt regardless of the intended use by the purchaser.

Note to Seller:

If this form is marked as a blanket certificate, it can be considered part of any order given you for farm

equipment or supplies qualified for exemption from tax and shall remain in force until revoked by written

notice to you.

Reproduction of Form:

Private reproduction of both sides of this form may be made without prior permission from the

Division of Taxation.

Have a question? Write: DIVISION OF TAXATION

Taxpayer Information Service

CN 260

Trenton, New Jersey 08646-0269

MAY BE REPRODUCED

(Front and Back Required)

ST-7

(11-96, R-5)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1