Application For Appeal Of Property Tax Form

ADVERTISEMENT

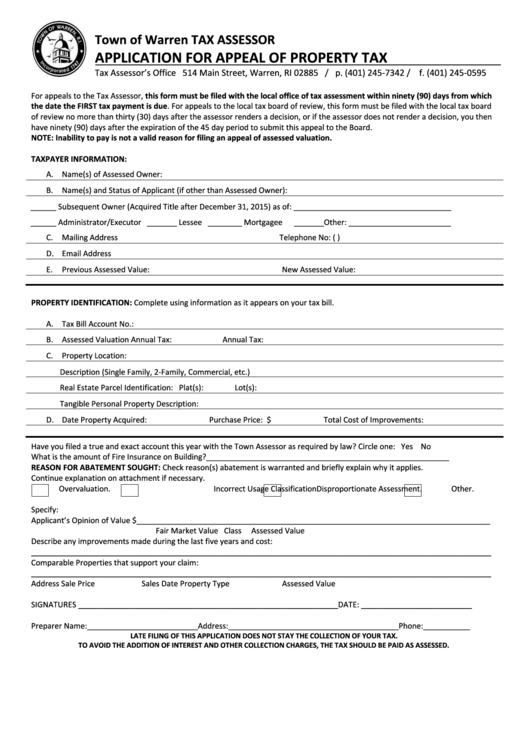

Town of Warren TAX ASSESSOR

APPLICATION FOR APPEAL OF PROPERTY TAX

Tax Assessor’s Office 514 Main Street, Warren, RI 02885 / p. (401) 245-7342 / f. (401) 245-0595

For appeals to the Tax Assessor, this form must be filed with the local office of tax assessment within ninety (90) days from which

the date the FIRST tax payment is due. For appeals to the local tax board of review, this form must be filed with the local tax board

of review no more than thirty (30) days after the assessor renders a decision, or if the assessor does not render a decision, you then

have ninety (90) days after the expiration of the 45 day period to submit this appeal to the Board.

NOTE: Inability to pay is not a valid reason for filing an appeal of assessed valuation.

TAXPAYER INFORMATION:

A. Name(s) of Assessed Owner:

B. Name(s) and Status of Applicant (if other than Assessed Owner):

______ Subsequent Owner (Acquired Title after December 31, 2015) as of: _____________________________________

______ Administrator/Executor _______ Lessee ________ Mortgagee

_______ Other: ________________________

C. Mailing Address

Telephone No: (

)

D. Email Address

E.

Previous Assessed Value:

New Assessed Value:

PROPERTY IDENTIFICATION: Complete using information as it appears on your tax bill.

A. Tax Bill Account No.:

B. Assessed Valuation Annual Tax:

Annual Tax:

C. Property Location:

Description (Single Family, 2-Family, Commercial, etc.)

Real Estate Parcel Identification: Plat(s):

Lot(s):

Tangible Personal Property Description:

D. Date Property Acquired:

Purchase Price: $

Total Cost of Improvements:

Have you filed a true and exact account this year with the Town Assessor as required by law? Circle one: Yes No

What is the amount of Fire Insurance on Building?_________________________________________________________

REASON FOR ABATEMENT SOUGHT: Check reason(s) abatement is warranted and briefly explain why it applies.

Continue explanation on attachment if necessary.

Overvaluation.

Incorrect Usage Classification

Disproportionate Assessment.

Other.

Specify:

Applicant’s Opinion of Value $___________________________________________________________________________________

Fair Market Value

Class

Assessed Value

Describe any improvements made during the last five years and cost:

____________________________________________________________________________________________________________

Comparable Properties that support your claim:

____________________________________________________________________________________________________________

Address

Sale Price

Sales Date

Property Type

Assessed Value

SIGNATURES _____________________________________________________________DATE: __________________________

Preparer Name:__________________________Address:________________________________________Phone:___________

LATE FILING OF THIS APPLICATION DOES NOT STAY THE COLLECTION OF YOUR TAX.

TO AVOID THE ADDITION OF INTEREST AND OTHER COLLECTION CHARGES, THE TAX SHOULD BE PAID AS ASSESSED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2