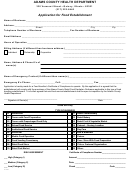

Application For Special Assessment Form Berkeley County Page 2

ADVERTISEMENT

AGRICULTURE

Signature required. Please sign below. Check all that apply. TMS _________________________

Definition: Agriculture real property shall mean any tract of real property which is used to raise, harvest, or store crops raised, breed or manage livestock,

or to produce plants, trees, fowl, or animals useful to man, including the preparation of the products raised thereon for man’s use and disposed of by

marketing or other means. It includes, but is not limited to, such real property used for agriculture, grazing, horticulture, forestry, dairying, and mariculture.

In the event at least 50% of a real property tract shall qualify as “agricultural real property,” the entire tract shall be also classified, provided no other

business for profit is being operated thereon. The term “agricultural real property”; shall not include any property used as the residence of the owner or

others in that the taxation of such property is specifically provided for in Section 2 (C) and (E) of Act 208 (DOR 117-124-7).

Is any portion of the entire tract being used for other than agricultural use? Yes ___ No ___

Portions of the property used for anything other than agricultural use will be assessed and appraised accordingly.

Number of Acres: Timberland _______ Commercial ______ Residence _______ Non-timberland (Crops) _______ Other _____________

Timberland:

Timberland tracts must be at least five (5) acres. Tracts of timberland must be devoted actively to growing trees for commercial use.

Tracts of timberland less than five acres may qualify if the tract is contiguous to another timberland tract with identical ownership and is at least five acres.

If timberland is less than 5 acres: Do you own any other qualifying timberland or qualifying non-timberland tracts which are contiguous to or under the

same management system as this tract? Yes ___ No ____ If yes, TMS# ______________________________________

Commercial:

If owned by a corporation, does the corporation: Have more than ten shareholders? Yes___ No ___

Have as a shareholder a person (other than an estate) who is not an individual? Yes ___ No ___

Have a nonresident alien as a shareholder? Yes ___ No ___ Is any portion of this tract being used for other than agricultural profit? Yes___ No ___

Non-timberland (Crops):

List type of Crop: _____________________ Non-timberland tracts must be at least ten (10) acres

Did you file a farm income tax return? Yes ___ No ___ Do you own any other crop-land tracts contiguous to this tract that meet the 10 acre minimum

requirement when added together? Yes ___ No ___ If yes, TMS#___________________________

The owner earned at least $1,000 gross farm income in at least three of the past five years if this is an initial application. Yes ___ No ___

Other

: List what land is used for: _____________________________________________________________________________________________

Agriculture Certification:

If Applying for Agricultural Use: It is unlawful for a person to knowingly and willfully make a false statement on the application required pursuant to section 12-43-220 (d) (3)

to a county assessor for the classification of property as agricultural real property or for the special assessment ratio for certain agricultural real property. A person violating

the provisions of this section is guilty of a misdemeanor and upon conviction, must be fined not more than $200. In making this application, I certify the property which is the

subject of this application meets the requirements to qualify as agricultural real property as of January first of the current tax year. I also authorize the assessor to verify

farm income with the Department of Revenue and Taxation, the Internal Revenue Service or the Agricultural Stabilization and Conservation Service.

Required Owner or Agent’s Signature: ______________________________________________________Date:________________ Phone: ______________________

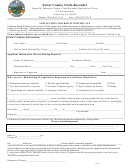

APPLICATION FOR SPECIAL ASSESSMENT AS LEGAL RESIDENCE

DEFINITION OF LEGAL RESIDENCE

For property tax purposes the term “Legal Residence” shall mean the permanent home or dwelling place

owned by person and occupied by the owner thereof. It shall be the place where he intends to remain permanently for an indefinite time even though he

may temporarily be living at another location. (DOR 117-124.6)

The legal residence and not more than five acres contiguous thereto, when owned totally or in part in fee or by life estate and occupied by the owner of the

interest, is taxed on an assessment equal to four percent of the fair market value of the property. (12-43-220 (c)(1))

42 U.S.C. 405(c)(2)(c)(i) allows a State (or political subdivision thereof) to utilize an individual’s Social Security number in connection with the

administration of any tax. South Carolina Code of Regulations number 117-1800.1 provides that any person applying for the 4% legal residence

assessment ratio must include owner’s name(s) and Social Security number(s) on the application for special assessment as legal residence.

QUALIFICATION REQUIREMENTS

For purposes of the assessment ratio allowed pursuant to this item, a residence does not qualify as a legal residence unless the residence is determined

to be the domicile of the owner-applicant. (12-43-220 (c)(1)

To qualify for the special property tax assessment ratio allowed by this item, the owner-occupant must have actually owned and occupied the residence as

his legal residence and been domiciled at that address for some period during the applicable tax year and remain in that status at the time of filing the

application required by this term. (12-43-220(c)(2)(i).

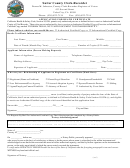

ROLL-BACK TAXES (S.C. CODE 12-43-220 (d) (4)

When real property which is in agricultural use and is being valued, assessed and taxed under the provisions of this article, is applied to a use other than

agricultural, it shall be subject to additional taxes, hereinafter referred to as roll-back taxes, in an amount equal to the difference, if any, between the taxes

paid or payable on the basis of the valuation and the assessment authorized hereunder and the taxes that would have been paid or payable had the real

property been valued, assessed and taxed as other real property in the taxing district, in the current tax year (the year of change in use) and each of the

five tax years immediately preceding in which the real property was valued, assessed and taxed as herein provided.

RETURN THIS APPLICATION NOW

FAILURE TO FILE WITHIN THE PRESCRIBED TIME, “TIME BEFORE THE FIRST PENALTY DATE FOR TAXES DUE FOR THE FIRST TAX YEAR

FOR WHICH THE ASSESSMENT IS CLAIMED” (BEFORE NEXT JAN 16

) SHALL CONSTITUTE ABANDONMENT OF THE OWNER’S RIGHT FOR

TH

THIS CLASSIFICATION FOR THE CURRENT TAX YEAR.

(SEC 23, ACT 361 OF 1992 FOR LEGAL RESIDENCE; SEC 3, ACT 920 OF 1994 FOR AGRICULTURE USE VALUE.)

Revised 6/8/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2