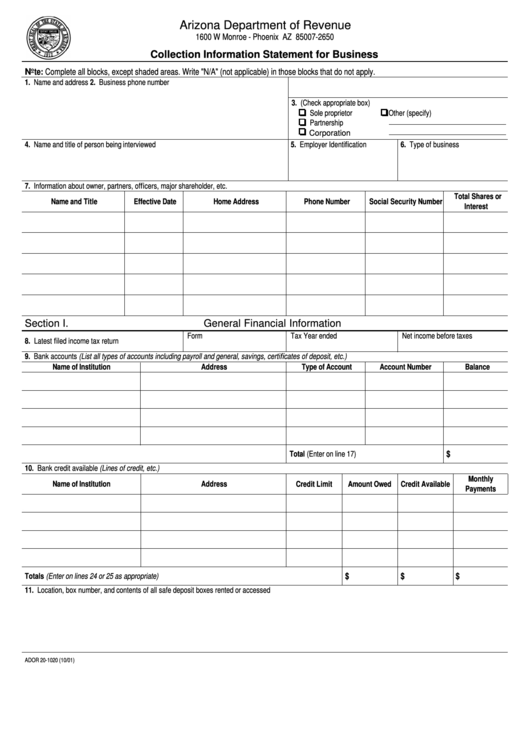

Form Ador 20-1020 - Collection Information Statement For Business

ADVERTISEMENT

Arizona Department of Revenue

1600 W Monroe - Phoenix AZ 85007-2650

Collection Information Statement for Business

Note: Complete all blocks, except shaded areas. Write "N/A" (not applicable) in those blocks that do not apply.

1. Name and address

2. Business phone number

3. (Check appropriate box)

Sole proprietor

Other (specify)

Partnership

Corporation

4. Name and title of person being interviewed

5. Employer Identification

6. Type of business

7. Information about owner, partners, officers, major shareholder, etc.

Total Shares or

Name and Title

Effective Date

Home Address

Phone Number

Social Security Number

Interest

Section I.

General Financial Information

Form

Tax Year ended

Net income before taxes

8. Latest filed income tax return

9. Bank accounts (List all types of accounts including payroll and general, savings, certificates of deposit, etc.)

Name of Institution

Address

Type of Account

Account Number

Balance

$

Total (Enter on line 17)

10. Bank credit available (Lines of credit, etc.)

Monthly

Name of Institution

Address

Credit Limit

Amount Owed

Credit Available

Payments

Totals (Enter on lines 24 or 25 as appropriate)

$

$

$

11. Location, box number, and contents of all safe deposit boxes rented or accessed

ADOR 20-1020 (10/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4