Schedule E Depreciation Form 2006

ADVERTISEMENT

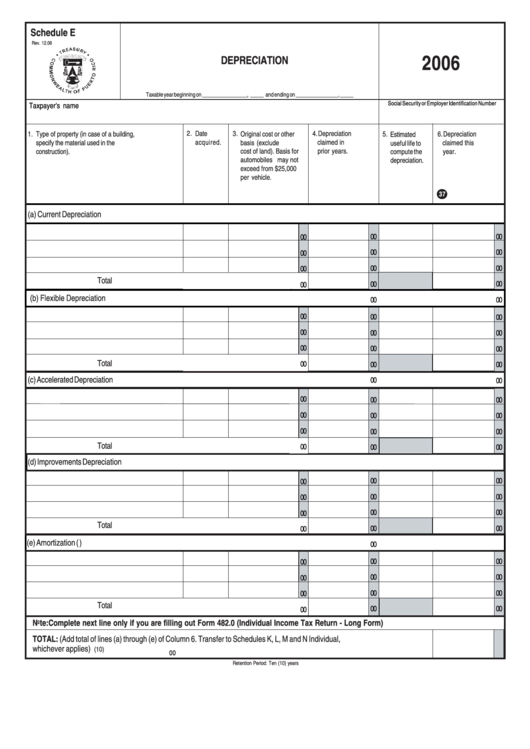

Schedule E

Rev. 12.06

2006

DEPRECIATION

Taxable year beginning on _________________, _____ and ending on ________________, _____

Social Security or Employer Identification Number

Taxpayer's name

2.

Date

3.

4. Depreciation

1.

Type of property (in case of a building,

Original cost or other

5. Estimated

6. Depreciation

acquired.

claimed in

specify the material used in the

basis (exclude

claimed this

useful life to

prior years.

construction).

cost of land). Basis for

year.

compute the

automobiles may not

depreciation.

exceed from $25,000

per vehicle.

37

(a) Current Depreciation

00

00

00

00

00

00

00

00

00

Total

00

00

00

(b) Flexible Depreciation

00

00

00

00

00

00

00

00

00

00

00

Total

00

00

00

(c) Accelerated Depreciation

00

00

00

00

00

00

00

00

00

00

00

Total

00

00

00

(d) Improvements Depreciation

00

00

00

00

00

00

00

00

00

Total

00

00

00

(e) Amortization (i.e. Goodwill)

00

00

00

00

00

00

00

00

00

00

Total

00

00

00

Note: Complete next line only if you are filling out Form 482.0 (Individual Income Tax Return - Long Form)

TOTAL: (Add total of lines (a) through (e) of Column 6. Transfer to Schedules K, L, M and N Individual,

whichever applies) .........................................................................................................................................................

(10)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1