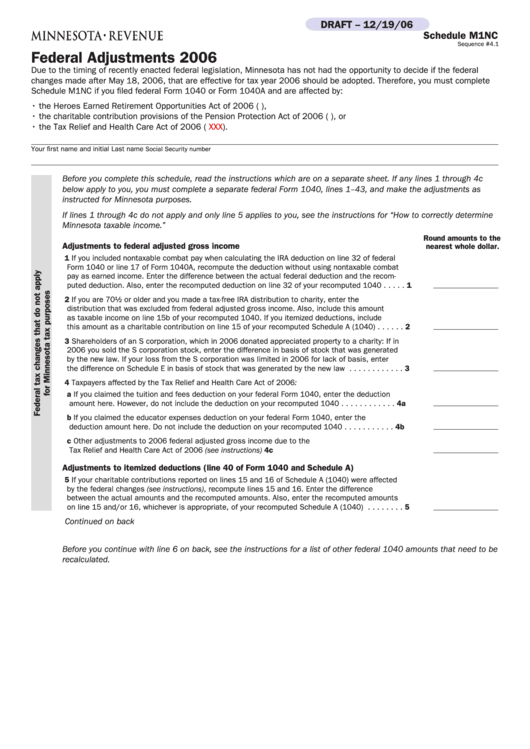

Schedule M1nc - Federal Adjustments 2006

ADVERTISEMENT

DRAFT -- 12/19/06

Schedule M1NC

Sequence #4.1

Federal Adjustments 2006

Due to the timing of recently enacted federal legislation, Minnesota has not had the opportunity to decide if the federal

changes made after May 18, 2006, that are effective for tax year 2006 should be adopted. Therefore, you must complete

Schedule M1NC if you filed federal Form 1040 or Form 1040A and are affected by:

• the Heroes Earned Retirement Opportunities Act of 2006 (P.L. 109-227),

• the charitable contribution provisions of the Pension Protection Act of 2006 (P.L. 109-280), or

• the Tax Relief and Health Care Act of 2006 (P.L. 109-XXX).

Your first name and initial

Last name

Social Security number

Before you complete this schedule, read the instructions which are on a separate sheet. If any lines 1 through 4c

below apply to you, you must complete a separate federal Form 1040, lines 1–43, and make the adjustments as

instructed for Minnesota purposes.

If lines 1 through 4c do not apply and only line 5 applies to you, see the instructions for “How to correctly determine

Minnesota taxable income.”

Round amounts to the

Adjustments to federal adjusted gross income

nearest whole dollar.

1 If you included nontaxable combat pay when calculating the IRA deduction on line 32 of federal

Form 1040 or line 17 of Form 1040A, recompute the deduction without using nontaxable combat

pay as earned income. Enter the difference between the actual federal deduction and the recom-

puted deduction. Also, enter the recomputed deduction on line 32 of your recomputed 1040 . . . . . 1

2 If you are 70½ or older and you made a tax-free IRA distribution to charity, enter the

distribution that was excluded from federal adjusted gross income. Also, include this amount

as taxable income on line 15b of your recomputed 1040. If you itemized deductions, include

this amount as a charitable contribution on line 15 of your recomputed Schedule A (1040) . . . . . . 2

3 Shareholders of an S corporation, which in 2006 donated appreciated property to a charity: If in

2006 you sold the S corporation stock, enter the difference in basis of stock that was generated

by the new law. If your loss from the S corporation was limited in 2006 for lack of basis, enter

the difference on Schedule E in basis of stock that was generated by the new law . . . . . . . . . . . . 3

4 Taxpayers affected by the Tax Relief and Health Care Act of 2006:

a If you claimed the tuition and fees deduction on your federal Form 1040, enter the deduction

amount here. However, do not include the deduction on your recomputed 1040 . . . . . . . . . . . . 4a

b If you claimed the educator expenses deduction on your federal Form 1040, enter the

deduction amount here. Do not include the deduction on your recomputed 1040 . . . . . . . . . . . 4b

c Other adjustments to 2006 federal adjusted gross income due to the

Tax Relief and Health Care Act of 2006 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c

Adjustments to itemized deductions (line 40 of Form 1040 and Schedule A)

5 If your charitable contributions reported on lines 15 and 16 of Schedule A (1040) were affected

by the federal changes (see instructions), recompute lines 15 and 16. Enter the difference

between the actual amounts and the recomputed amounts. Also, enter the recomputed amounts

on line 15 and/or 16, whichever is appropriate, of your recomputed Schedule A (1040) . . . . . . . . 5

Continued on back

Before you continue with line 6 on back, see the instructions for a list of other federal 1040 amounts that need to be

recalculated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2