Mercantile License Application And Tax Return - Plymouth Township - 2016

ADVERTISEMENT

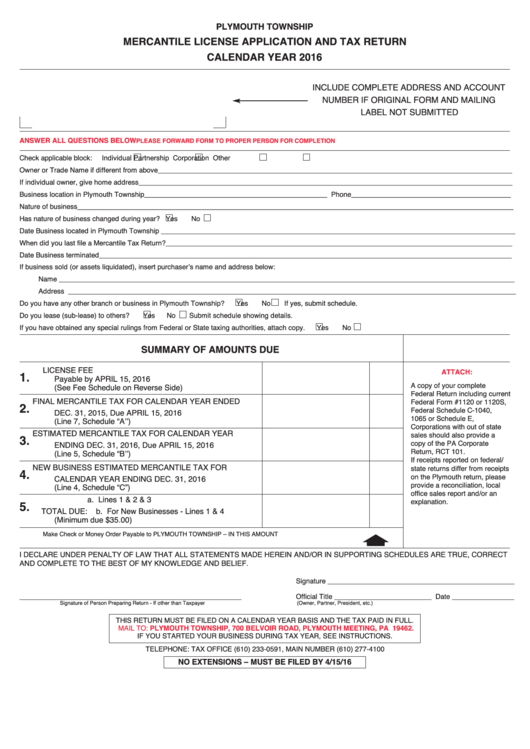

PLYMOUTH TOWNSHIP

MERCANTILE LICENSE APPLICATION AND TAX RETURN

CALENDAR YEAR 2016

INCLUDE COMPLETE ADDRESS AND ACCOUNT

NUMBER IF ORIGINAL FORM AND MAILING

LABEL NOT SUBMITTED

ANSWER ALL QUESTIONS BELOW

PLEASE FORWARD FORM TO PROPER PERSON FOR COMPLETION

Check applicable block:

Individual

Partnership

Corporation

Other

Owner or Trade Name if different from above ___________________________________________________________________________________________

If individual owner, give home address ________________________________________________________________________________________________

Business location in Plymouth Township _______________________________________________ Phone_________________________________________

Nature of business ________________________________________________________________________________________________________________

Has nature of business changed during year?

Yes

No

Date Business located in Plymouth Township ___________________________________________________________________________________________

When did you last file a Mercantile Tax Return? _________________________________________________________________________________________

Date Business terminated __________________________________________________________________________________________________________

If business sold (or assets liquidated), insert purchaser’s name and address below:

Name _____________________________________________________________________________________________________________________

Address ___________________________________________________________________________________________________________________

Do you have any other branch or business in Plymouth Township?

Yes

No

If yes, submit schedule.

Do you lease (sub-lease) to others?

Yes

No

Submit schedule showing details.

If you have obtained any special rulings from Federal or State taxing authorities, attach copy.

Yes

No

SUMMARY OF AMOUNTS DUE

1.

LICENSE FEE

ATTACH:

Payable by APRIL 15, 2016

A copy of your complete

(See Fee Schedule on Reverse Side)

Federal Return including current

2.

FINAL MERCANTILE TAX FOR CALENDAR YEAR ENDED

Federal Form #1120 or 1120S,

Federal Schedule C-1040,

DEC. 31, 2015, Due APRIL 15, 2016

1065 or Schedule E,

(Line 7, Schedule “A’’)

Corporations with out of state

3.

ESTIMATED MERCANTILE TAX FOR CALENDAR YEAR

sales should also provide a

ENDING DEC. 31, 2016, Due APRIL 15, 2016

copy of the PA Corporate

(Line 5, Schedule “B’’)

Return, RCT 101.

If receipts reported on federal/

4.

NEW BUSINESS ESTIMATED MERCANTILE TAX FOR

state returns differ from receipts

on the Plymouth return, please

CALENDAR YEAR ENDING DEC. 31, 2016

provide a reconciliation, local

(Line 4, Schedule “C”)

office sales report and/or an

5.

a. Lines 1 & 2 & 3

explanation.

TOTAL DUE:

b. For New Businesses - Lines 1 & 4

(Minimum due $35.00)

Make Check or Money Order Payable to PLYMOUTH TOWNSHIP – IN THIS AMOUNT

I DECLARE UNDER PENALTY OF LAW THAT ALL STATEMENTS MADE HEREIN AND/OR IN SUPPORTING SCHEDULES ARE TRUE, CORRECT

AND COMPLETE TO THE BEST OF MY KNOWLEDGE AND BELIEF.

Signature ________________________________________________

_________________________________________________________

Official Title _________________________ Date ________________

Signature of Person Preparing Return - If other than Taxpayer

(Owner, Partner, President, etc.)

THIS RETURN MUST BE FILED ON A CALENDAR YEAR BASIS AND THE TAX PAID IN FULL.

MAIL TO: PLYMOUTH TOWNSHIP, 700 BELVOIR ROAD, PLYMOUTH MEETING, PA 19462.

IF YOU STARTED YOUR BUSINESS DURING TAX YEAR, SEE INSTRUCTIONS.

TELEPHONE: TAX OFFICE (610) 233-0591, MAIN NUMBER (610) 277-4100

NO EXTENSIONS – MUST BE FILED BY 4/15/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2