Health Care Programs Enrollment/change Form

ADVERTISEMENT

OSR 5-200 (Rev 01-24-13)

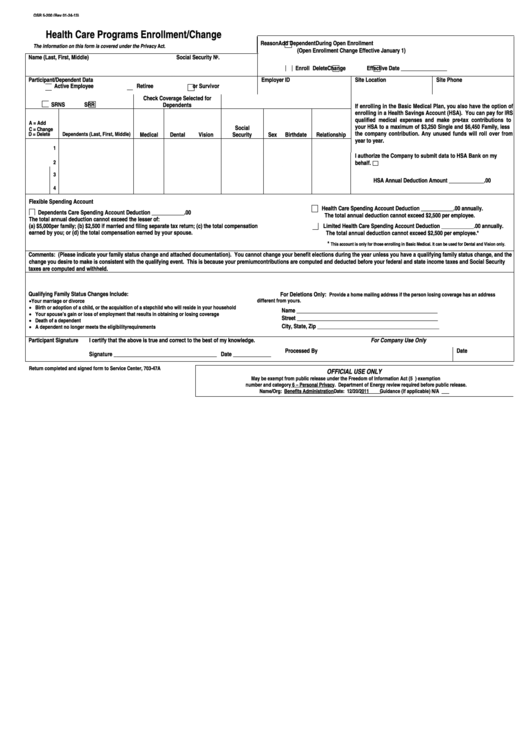

Health Care Programs Enrollment/Change

Reason

Add Dependent During Open Enrollment

The information on this form is covered under the Privacy Act.

(Open Enrollment Change Effective January 1)

Name (Last, First, Middle)

Social Security No.

Enroll

Delete

Change

Effective Date _________________

Participant/Dependent Data

Employer ID

Site Location

Site Phone

Active Employee

Retiree

or Survivor

Check Coverage Selected for

SRNS

SRR

Dependents

If enrolling in the Basic Medical Plan, you also have the option of

enrolling in a Health Savings Account (HSA). You can pay for IRS

qualified medical expenses and make pre-tax contributions to

A = Add

your HSA to a maximum of $3,250 Single and $6,450 Family, less

Social

C = Change

the company contribution. Any unused funds will roll over from

Medical

Dental

Vision

Security

Sex

Birthdate

Relationship

D = Delete

Dependents (Last, First, Middle)

year to year.

1

I authorize the Company to submit data to HSA Bank on my

2

behalf.

3

HSA Annual Deduction Amount _____________.00

4

Flexible Spending Account

Health Care Spending Account Deduction ____________.00 annually.

Dependents Care Spending Account Deduction ____________.00

The total annual deduction cannot exceed $2,500 per employee.

The total annual deduction cannot exceed the lesser of:

(a) $5,000 per family; (b) $2,500 if married and filing separate tax return; (c) the total compensation

Limited Health Care Spending Account Deduction ____________.00 annually.

earned by you; or (d) the total compensation earned by your spouse.

The total annual deduction cannot exceed $2,500 per employee.*

*

This account is only for those enrolling in Basic Medical. It can be used for Dental and Vision only.

Comments: (Please indicate your family status change and attached documentation). You cannot change your benefit elections during the year unless you have a qualifying family status change, and the

change you desire to make is consistent with the qualifying event. This is because your premium contributions are computed and deducted before your federal and state income taxes and Social Security

taxes are computed and withheld.

Qualifying Family Status Changes Include:

For Deletions Only:

Provide a home mailing address if the person losing coverage has an address

• Your marriage or divorce

different from yours.

• Birth or adoption of a child, or the acquisition of a stepchild who will reside in your household

Name ____________________________________________________

• Your spouse’s gain or loss of employment that results in obtaining or losing coverage

Street ____________________________________________________

• Death of a dependent

City, State, Zip _____________________________________________

• A dependent no longer meets the eligibility requirements

Participant Signature

I certify that the above is true and correct to the best of my knowledge.

For Company Use Only

Processed By

Date

Signature ______________________________________ Date ______________

Return completed and signed form to Service Center, 703-47A

OFFICIAL USE ONLY

May be exempt from public release under the Freedom of Information Act (5 U.S.C. 552) exemption

number and category 6 – Personal Privacy. Department of Energy review required before public release.

Name/Org: Benefits Administration

Date: 12/20/2011

Guidance (if applicable) N/A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1