Form Mf-023w - Nonagricultural Users - Off-Road Fuel Tax Refund Claim 2000

ADVERTISEMENT

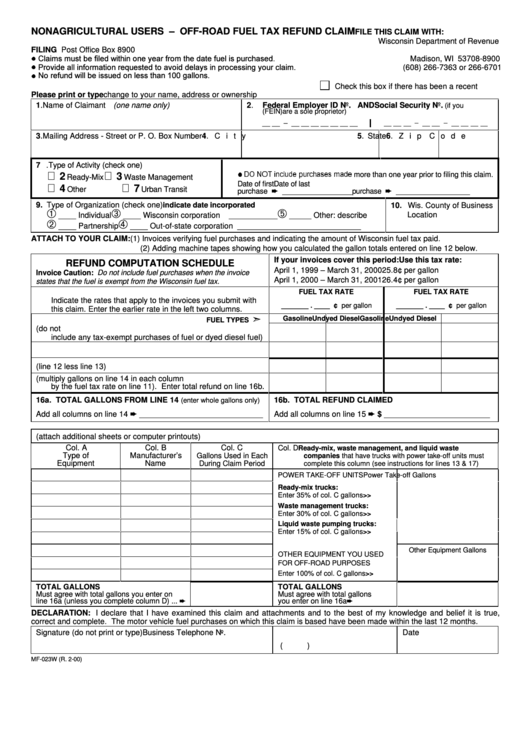

NONAGRICULTURAL USERS – OFF-ROAD FUEL TAX REFUND CLAIM

FILE THIS CLAIM WITH:

Wisconsin Department of Revenue

FILING REMINDERS...

Post Office Box 8900

Madison, WI 53708-8900

(608) 266-7363 or 266-6701

Check this box if there has been a recent

Please print or type

change to your name, address or ownership

1. Name of Claimant (one name only)

2.

Federal Employer ID No.

AND Social Security No.

(if you

(FEIN)

are a sole proprietor)

__ __ – __ __ __ __ __ __ __

ÃÃÃÃÃÃffÃffÃffÃñÃÃffÃffÃñÃÃffÃffÃffÃff

3. Mailing Address - Street or P. O. Box Number

4. City

5. State

6. Zip Code

7. Type of Activity (check one)

8. DATES OF FUEL PURCHASES COVERED BY THIS REFUND CLAIM

more than one year prior to filing this claim.

2

3

Ã9PÃIPUÃvpyˆqrÈ…puh†r†Ã€hqrÃ

Ready-Mix

Waste Management

Date of first

Date of last

4

7

Other

Urban Transit

purchase

_________________

purchase

__________________

9. Type of Organization (check one)

indicate date incorporated

10. Wis. County of Business

Location

____ Individual

____ Wisconsin corporation

___________

_____ Other: describe

____ Partnership

____ Out-of-state corporation ___________

_________________

ATTACH TO YOUR CLAIM:

(1) Invoices verifying fuel purchases and indicating the amount of Wisconsin fuel tax paid.

(2) Adding machine tapes showing how you calculated the gallon totals entered on line 12 below.

If your invoices cover this period:

Use this tax rate:

REFUND COMPUTATION SCHEDULE

April 1, 1999 – March 31, 2000

25.8¢ per gallon

Invoice Caution: Do not include fuel purchases when the invoice

April 1, 2000 – March 31, 2001

26.4¢ per gallon

states that the fuel is exempt from the Wisconsin fuel tax.

11. Motor vehicle fuel tax rates.

FUEL TAX RATE

FUEL TAX RATE

Indicate the rates that apply to the invoices you submit with

_______ . ____ ¢ per gallon

_______ . ____ ¢ per gallon

this claim. Enter the earlier rate in the left two columns.

Gasoline

Undyed Diesel

Gasoline

Undyed Diesel

FUEL TYPES

12. Total gallons purchased and used at each fuel rate (do not

include any tax-exempt purchases of fuel or dyed diesel fuel)

13. Gallons included on line 12 used in licensed cars and trucks

14. Gallons on which refund is claimed (line 12 less line 13)

15. Compute Refund (multiply gallons on line 14 in each column

by the fuel tax rate on line 11). Enter total refund on line 16b.

16a. TOTAL GALLONS FROM LINE 14

16b. TOTAL REFUND CLAIMED

(enter whole gallons only)

Add all columns on line 14

____________________________

Add all columns on line 15

$ ________________________

17. List equipment in which motor vehicle fuel was used for off-road purposes (attach additional sheets or computer printouts)

Col. A

Col. B

Col. C

Col. D

Ready-mix, waste management, and liquid waste

Type of

Manufacturer’s

Gallons Used in Each

companies that have trucks with power take-off units must

Equipment

Name

During Claim Period

complete this column (see instructions for lines 13 & 17)

POWER TAKE-OFF UNITS

Power Take-off Gallons

Ready-mix trucks:

Enter 35% of col. C gallons

>>

Waste management trucks:

Enter 30% of col. C gallons

>>

Liquid waste pumping trucks:

Enter 15% of col. C gallons

>>

Other Equipment Gallons

OTHER EQUIPMENT YOU USED

FOR OFF-ROAD PURPOSES

Enter 100% of col. C gallons

>>

TOTAL GALLONS

TOTAL GALLONS

Must agree with total gallons you enter on

Must agree with total gallons

ine 16a (unless you complete column D) ...

you enter on line 16a

l

.................

DECLARATION: I declare that I have examined this claim and attachments and to the best of my knowledge and belief it is true,

correct and complete. The motor vehicle fuel purchases on which this claim is based have been made within the last 12 months.

Signature (do not print or type)

Business Telephone No.

Date

(

)

MF-023W (R. 2-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1