Form Rmft-11 - Illinois Motor Fuel Tax Refund Claim - 2000

ADVERTISEMENT

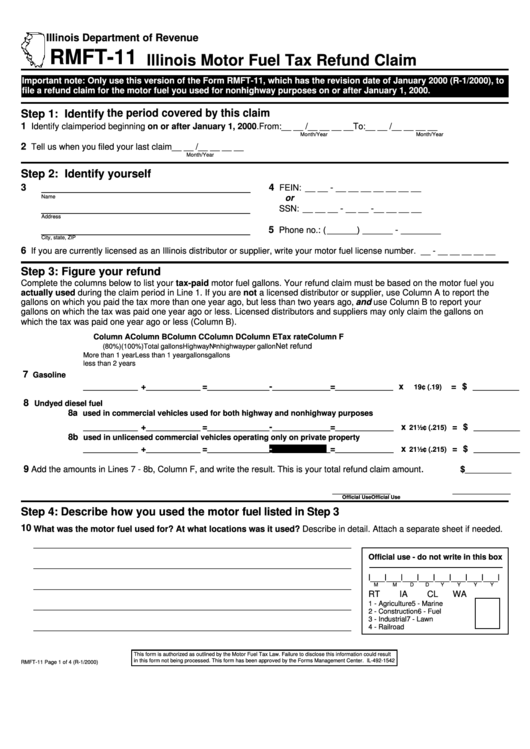

Illinois Department of Revenue

RMFT-11

Illinois Motor Fuel Tax Refund Claim

Important note: Only use this version of the Form RMFT-11, which has the revision date of January 2000 (R-1/2000), to

file a refund claim for the motor fuel you used for nonhighway purposes on or after January 1, 2000.

Step 1: Identify the period covered by this claim

1

Identify claim period beginning on or after January 1, 2000. From:__ __ /__ __ __ __

To:__ __ /__ __ __ __

Month/Year

Month/Year

2

Tell us when you filed your last claim __ __ /__ __ __ __

Month/Year

Step 2: Identify yourself

_____________________________

3

4

FEIN: __ __ - __ __ __ __ __ __ __

or

Name

_____________________________

SSN: __ __ __ - __ __ -__ __ __ __

Address

_____________________________

5

Phone no.: (______) ______ - ________

City, state, ZIP

6

If you are currently licensed as an Illinois distributor or supplier, write your motor fuel license number.

__ - __ __ __ __ __

Step 3: Figure your refund

Complete the columns below to list your tax-paid motor fuel gallons. Your refund claim must be based on the motor fuel you

actually used during the claim period in Line 1. If you are not a licensed distributor or supplier, use Column A to report the

gallons on which you paid the tax more than one year ago, but less than two years ago, and use Column B to report your

gallons on which the tax was paid one year ago or less. Licensed distributors and suppliers may only claim the gallons on

which the tax was paid one year ago or less (Column B).

Column A

Column B

Column C

Column D

Column E

Tax rate

Column F

Net refund

(80%)

(100%)

Total gallons

Highway

Nonhighway

per gallon

More than 1 year

Less than 1 year

gallons

gallons

less than 2 years

7

Gasoline

+

=

-

=

x

= $

______________

______________

________________

_______________

_______________

19¢ (.19)

____________

8

Undyed diesel fuel

8a

used in commercial vehicles used for both highway and nonhighway purposes

+

=

-

=

x

= $

______________

______________

________________

_______________

_______________

21½¢ (.215)

____________

8b

used in unlicensed commercial vehicles operating only on private property

+

=

-

=

x

= $

______________

______________

________________

_______________

_______________

21½¢ (.215)

____________

.

9

Add the amounts in Lines 7 - 8b, Column F, and write the result. This is your total refund claim amount

$

____________

_______________

_______________

Official Use

Official Use

Step 4: Describe how you used the motor fuel listed in Step 3

10

What was the motor fuel used for? At what locations was it used? Describe in detail. Attach a separate sheet if needed.

___________________________________________________________________

Official use - do not write in this box

___________________________________________________________________

l___l___l___l___l___l___l___l___l

___________________________________________________________________

M

M

D

D

Y

Y

Y

Y

RT

IA

CL

WA

1 - Agriculture

5 - Marine

I.D.

___________________________________________________________________

2 - Construction 6 - Fuel

3 - Industrial

7 - Lawn

___________________________________________________________________

4 - Railroad

This form is authorized as outlined by the Motor Fuel Tax Law. Failure to disclose this information could result

in this form not being processed. This form has been approved by the Forms Management Center. IL-492-1542

RMFT-11 Page 1 of 4 (R-1/2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4