Instructions For Filing The Annual Report Of Unclaimed Property Safe Deposit Boxes And Safekeeping Items Using Form Upd205 And Upd206 - 2012 Page 2

ADVERTISEMENT

INTRODUCTION

The Illinois Uniform Disposition of Unclaimed Property Act (Act) requires that safe deposit boxes with contents which

have remained unclaimed for five (5) years after expiration of lease be presumed abandoned. Therefore, safe deposit

boxes whose leases expired June 30, 2007 and prior are considered abandoned and reportable. The due date for filing

the Annual Report of Safe Deposit Boxes is November 1, 2012.

If you have abandoned safe deposit boxes that are reportable and the owners have not been contacted previously

concerning their accounts' inactivity, Section 1025/11(e) of the Act requires that:

"before filing the annual report the holder of property presumed abandoned under this act shall communicate with the

owner at his last known address if any address is known to the holder,... If the holder has not communicated with the

owner at his last known address at least 120 days before the deadline for filing the annual report, the holder shall mail,

at least 60 days before that deadline, a letter by first class mail to the owner at his last known address, if any address

not shown to be inaccurate is known to the holder."

In order for a safe deposit box to not be considered abandoned, the owner must have satisfied all back rent and legal

charges pursuant to the rental contract and/or other charges permitted by law.

FORMS TO FILE AND WHERE TO SEND THEM

The reporting forms have changed so read them carefully.

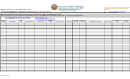

Enclosed are the Annual Report of Unclaimed

Property Safe Deposit Boxes (form UPD205) and the Drilling Statement (form UPD206). The Annual Report of

Unclaimed Property Safe Deposit Boxes must be completed in its entirety, verified for accuracy, signed, and filed

regardless of whether you have abandoned safe deposit boxes to report. The Drilling Statement (form UPD206) must

be submitted only if you have abandoned safe deposit boxes with contents to report. Form UPD206 must be completed

for each box and submitted at the same time as form UPD205. Your report must be submitted on these forms.

However, if boxes have been inventoried prior to receiving these forms, you may attach your inventory sheet to form

UPD206 after completing the owner information. If you are an institution filing for more than one location, a separate

Annual Report (form UPD205) and Drilling Statement(s) (form UPD206) must be completed and filed for each location.

Copies of completed forms should be made for your files. Inaccurate or incomplete reports are not considered to be

in compliance with reporting requirements, and may result in fees and charges as provided for in Section

1025/25.5 of the Act.

Mail completed forms to:

ILLINOIS STATE TREASURER’S OFFICE

UNCLAIMED PROPERTY DIVISION

PO BOX 19496

(See cover page for express mailing address.)

SPRINGFIELD IL 62794-9496

DELIVERY OF CONTENTS

Once we have received and processed the information from your annual report and we are ready to receive and

inventory your boxes, we will notify you of a specific week in which you can mail or ship your safe deposit contents to us.

This will eliminate the need for you to travel to our office to deliver contents and sit through a cumbersome inventory and

the need for us to travel to outlying areas of the state to collect boxes. Once we receive the contents, we will perform

the inventory and record the data. Hopefully, this will make the process less time consuming and costly for both parties.

REMEMBER . . . DO NOT SHIP CONTENTS TO US UNTIL YOU ARE INSTRUCTED IN WRITING TO DO SO.

If you have any questions concerning the completion and filing of this report, drilling, inventory or delivery, please call

(217) 785-6998.

INSTRUCTIONS FOR COMPLETING FORM UPD205

This barcoded form is for filing the annual report for the location identified in Section B only. It may not be used for filing

the annual report for any other location.

Section A - Identifies the name and address of the business this report was mailed to and who is responsible for filing

the annual report. If the information is different from that in Section B, it indicates that business (A) is filing the report for

branch (B) located at a different address.

Section B - Identifies the name and location for which boxes are being reported.

Section C - If the name and/or mailing address should be changed for the business shown in Section A, or for the

name and location for which the report is being filed in Section B, note changes here. A business filing for more than

one location must file a separate report for each location.

-- 1 --

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5