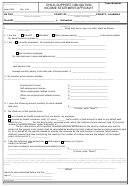

Form CS-41 (Back)

EXAMPLES OF INCOME THAT MUST BE INCLUDED IN YOUR GROSS MONTHLY INCOME

1.

Employment Income – shall include, but not be limited to, salary, wages, bonuses, commissions, severance

pay, worker’s compensation, pension income, unemployment insurance, disability insurance, and Social

Security benefits.

2.

Self–Employment Income – shall include, but not be limited to, income from self-employment, rent, royalties,

proprietorship of a business, or joint ownership of a partnership or closely held corporation. “Gross income”

means gross receipts minus ordinary and necessary expenses required to produce this income.

3.

Other Employment–Related Income – shall include, but not be limited to, the average monthly value of any

expense reimbursements or in-kind payments received in the course of employment that are significant and

reduce personal living expenses, such as a furnished automobile, a clothing allowance, and a housing

allowance.

4.

Other Non-Employment-Related Income – shall include, but not be limited to, dividends, interest, annuities,

capital gains, gifts, prizes, and pre-existing periodic alimony.

RULE 32, ALABAMA RULES OF JUDICIAL ADMINISTRATION, PROVIDES THE FOLLOWING DEFINITIONS:

Income. For purposes of the guidelines specified in this Rule, “income” means the actual gross income of a

parent, if the parent is employed to full capacity, or if the parent is unemployed or underemployed, then it

means the actual gross income the parent has the ability to earn.

Gross Income.

“Gross income” includes income from any source, and includes, but is not limited to, income from salaries,

wages, commissions, bonuses, dividends, severance pay, pensions, interest, trust income, annuities, capital

gains, Social Security benefits, workers’ compensation benefits, unemployment-insurance benefits, disability-

insurance benefits, gifts, prizes, and preexisting periodic alimony.

“Gross income” does not include child support received for other children or benefits received from means-

tested public-assistance programs, including, but not limited to, Temporary Assistance for Needy Families,

Supplemental Security Income, food stamps, and general assistance.

Self–employment Income.

For income from self-employment, rent, royalties, proprietorship of business, or joint ownership of a

partnership or closely held corporation, “gross income” means gross receipts minus ordinary and necessary

expenses required to produce such income, as allowed by the Internal Revenue Service, with the exceptions

noted in Rule 32 (B)(3)(b).

Under those exceptions, “ordinary and necessary expenses” does not include amounts allowable by the

Internal Revenue Service for the accelerated component of depreciation expenses, investment tax credits, or

any other business expenses determined by the court to be inappropriate for determining gross income for

purposes of calculating child support.

Other Income. Expense reimbursements or in-kind payments received by a parent in the course of

employment of self-employment or operation of a business shall be counted as income if they are significant and

reduce personal living expenses.

1

1 2

2