Form Ir - Tax Return For Individuals Instructions - Exemption Certificate - Visa/mastercard Authorization Voucher - 2006

ADVERTISEMENT

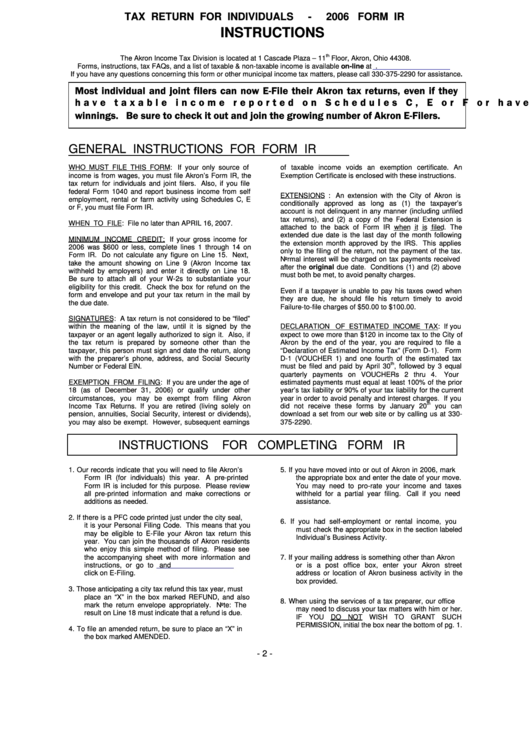

TAX RETURN FOR INDIVIDUALS

-

2006 FORM IR

INSTRUCTIONS

th

The Akron Income Tax Division is located at 1 Cascade Plaza – 11

Floor, Akron, Ohio 44308.

Forms, instructions, tax FAQs, and a list of taxable & non-taxable income is available on-line at

If you have any questions concerning this form or other municipal income tax matters, please call 330-375-2290 for assistance.

Most individual and joint filers can now E-File their Akron tax returns, even if they

have taxable income reported on Schedules C, E or F or have taxable lottery

winnings. Be sure to check it out and join the growing number of Akron E-Filers.

GENERAL INSTRUCTIONS FOR FORM IR

WHO MUST FILE THIS FORM: If your only source of

of taxable income voids an exemption certificate. An

income is from wages, you must file Akron’s Form IR, the

Exemption Certificate is enclosed with these instructions.

tax return for individuals and joint filers. Also, if you file

federal Form 1040 and report business income from self

EXTENSIONS : An extension with the City of Akron is

employment, rental or farm activity using Schedules C, E

conditionally approved as long as (1) the taxpayer’s

or F, you must file Form IR.

account is not delinquent in any manner (including unfiled

tax returns), and (2) a copy of the Federal Extension is

WHEN TO FILE: File no later than APRIL 16, 2007.

attached to the back of Form IR when it is filed. The

extended due date is the last day of the month following

MINIMUM INCOME CREDIT: If your gross income for

the extension month approved by the IRS. This applies

2006 was $600 or less, complete lines 1 through 14 on

only to the filing of the return, not the payment of the tax.

Form IR. Do not calculate any figure on Line 15. Next,

Normal interest will be charged on tax payments received

take the amount showing on Line 9 (Akron Income tax

after the original due date. Conditions (1) and (2) above

withheld by employers) and enter it directly on Line 18.

must both be met, to avoid penalty charges.

Be sure to attach all of your W-2s to substantiate your

eligibility for this credit. Check the box for refund on the

Even if a taxpayer is unable to pay his taxes owed when

form and envelope and put your tax return in the mail by

they are due, he should file his return timely to avoid

the due date.

Failure-to-file charges of $50.00 to $100.00.

SIGNATURES: A tax return is not considered to be “filed”

within the meaning of the law, until it is signed by the

DECLARATION OF ESTIMATED INCOME TAX: If you

taxpayer or an agent legally authorized to sign it. Also, if

expect to owe more than $120 in income tax to the City of

the tax return is prepared by someone other than the

Akron by the end of the year, you are required to file a

taxpayer, this person must sign and date the return, along

“Declaration of Estimated Income Tax” (Form D-1). Form

with the preparer’s phone, address, and Social Security

D-1 (VOUCHER 1) and one fourth of the estimated tax

th

Number or Federal EIN.

must be filed and paid by April 30

, followed by 3 equal

quarterly payments on VOUCHERs 2 thru 4.

Your

EXEMPTION FROM FILING: If you are under the age of

estimated payments must equal at least 100% of the prior

18 (as of December 31, 2006) or qualify under other

year’s tax liability or 90% of your tax liability for the current

circumstances, you may be exempt from filing Akron

year in order to avoid penalty and interest charges. If you

th

Income Tax Returns. If you are retired (living solely on

did not receive these forms by January 20

you can

pension, annuities, Social Security, interest or dividends),

download a set from our web site or by calling us at 330-

you may also be exempt. However, subsequent earnings

375-2290.

INSTRUCTIONS

FOR COMPLETING FORM IR

1.

Our records indicate that you will need to file Akron’s

5.

If you have moved into or out of Akron in 2006, mark

Form IR (for individuals) this year.

A pre-printed

the appropriate box and enter the date of your move.

Form IR is included for this purpose. Please review

You may need to pro-rate your income and taxes

all pre-printed information and make corrections or

withheld for a partial year filing.

Call if you need

additions as needed.

assistance.

2.

If there is a PFC code printed just under the city seal,

6.

If you had self-employment or rental income, you

it is your Personal Filing Code. This means that you

must check the appropriate box in the section labeled

may be eligible to E-File your Akron tax return this

Individual’s Business Activity.

year. You can join the thousands of Akron residents

who enjoy this simple method of filing. Please see

the accompanying sheet with more information and

7.

If your mailing address is something other than Akron

instructions, or go to

and

or is a post office box, enter your Akron street

click on E-Filing.

address or location of Akron business activity in the

box provided.

3.

Those anticipating a city tax refund this tax year, must

place an “X” in the box marked REFUND, and also

8.

When using the services of a tax preparer, our office

mark the return envelope appropriately. Note: The

may need to discuss your tax matters with him or her.

result on Line 18 must indicate that a refund is due.

IF YOU DO NOT WISH TO GRANT SUCH

PERMISSION, initial the box near the bottom of pg. 1.

4.

To file an amended return, be sure to place an “X” in

the box marked AMENDED.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3