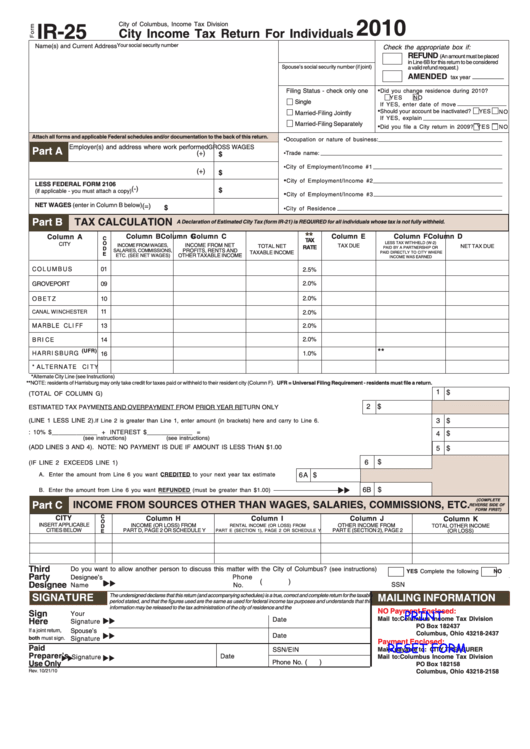

Form Ir-25 - City Income Tax Return For Individuals - City Of Columbus Income Tax Division - 2010

ADVERTISEMENT

2010

IR-25

City of Columbus, Income Tax Division

City Income Tax Return For Individuals

Name(s) and Current Address

Your social security number

Check the appropriate box if:

REFUND

(An amount must be placed

in Line 6B for this return to be considered

Spouse’s social security number (if joint)

a valid refund request.)

AMENDED

tax year

•

Filing Status - check only one

Did you change residence during 2010?

YES

NO

Single

If YES, enter date of move

•

Should your account be inactivated?

YES

N O

Married-Filing Jointly

If YES, explain

Married-Filing Separately

•

Did you file a City return in 2009?

YES

N O

Attach all forms and applicable Federal schedules and/or documentation to the back of this return.

•Occupation or nature of business:

Employer(s) and address where work performed

GROSS WAGES

Part A

(+)

•Trade name:

$

•City of Employment/Income #1

(+)

$

•

City of Employment/Income #2

LESS FEDERAL FORM 2106

(-)

$

(if applicable - you must attach a copy)

•

City of Employment/Income #3

NET WAGES (enter in Column B below)

(=)

$

•City of Residence

Part B

TAX CALCULATION

A Declaration of Estimated City Tax (form IR-21) is REQUIRED for all individuals whose tax is not fully withheld.

**

Column B

Column C

Column D

Column E

Column F

Column G

Column A

C

TAX

O

LESS TAX WITHHELD (W-2)

CITY

INCOME FROM NET

INCOME FROM WAGES,

TAX DUE

TOTAL NET

NET TAX DUE

RATE

PAID BY A PARTNERSHIP OR

D

SALARIES, COMMISSIONS,

PROFITS, RENTS AND

TAXABLE INCOME

PAID DIRECTLY TO CITY WHERE

E

OTHER TAXABLE INCOME

ETC. (SEE NET WAGES)

INCOME WAS EARNED

C O L U M B U S

01

2.5%

2.0%

GROVEPORT

09

2.0%

O B E T Z

10

11

CANAL WINCHESTER

2.0%

MARBLE CLIFF

13

2.0%

B R I C E

2.0%

14

**

(UFR)

HARRISBURG

16

1.0%

*ALTERNATE CITY

*Alternate City Line (see Instructions)

**NOTE: residents of Harrisburg may only take credit for taxes paid or withheld to their resident city (Column F). UFR = Universal Filing Requirement - residents must file a return.

1

$

1. TOTAL NET TAX DUE (TOTAL OF COLUMN G)...................................................................................................................................

2 $

2. LESS CREDITS FOR ESTIMATED TAX PAYMENTS AND OVERPAYMENT FROM PRIOR YEAR RETURN ONLY .......

3

$

3. BALANCE DUE (LINE 1 LESS LINE 2).

.......................

If Line 2 is greater than Line 1, enter amount (in brackets) here and carry to Line 6.

4. PENALTY: 10% $_____________ + INTEREST $_____________ = .....................................................................................................

$

4

(see instructions)

(see instructions)

5. TOTAL AMOUNT DUE (ADD LINES 3 AND 4). NOTE: NO PAYMENT IS DUE IF AMOUNT IS LESS THAN $1.00.......................................

5

$

6

$

6. OVERPAYMENT CLAIMED (IF LINE 2 EXCEEDS LINE 1) .............................................................................

6A

A. Enter the amount from Line 6 you want CREDITED to your next year tax estimate...........

$

$

6B

B. Enter the amount from Line 6 you want REFUNDED (must be greater than $1.00)

(COMPLETE

Part C

INCOME FROM SOURCES OTHER THAN WAGES, SALARIES, COMMISSIONS, ETC.

REVERSE SIDE OF

B

FORM FIRST)

CITY

C

Column H

Column I

Column J

Column K

O

INSERT APPLICABLE

INCOME (OR LOSS) FROM

OTHER INCOME FROM

TOTAL OTHER INCOME

D

RENTAL INCOME (OR LOSS) FROM

CITIES BELOW

PART D, PAGE 2 OR SCHEDULE Y

PART E (SECTION 2), PAGE 2

E

PART E (SECTION 1), PAGE 2 OR SCHEDULE Y

(OR LOSS)

Third

Do you want to allow another person to discuss this matter with the City of Columbus?

(see instructions)

YES Complete the following

NO

Party

Designee’s

Phone

(

)

Designee

SSN

Name

No.

SIGNATURE

MAILING INFORMATION

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable

period stated, and that the figures used are the same as used for federal income tax purposes and understands that this

information may be released to the tax administration of the city of residence and the I.R.S.

NO Payment Enclosed:

PRINT

Sign

Your

Mail to:

Columbus Income Tax Division

Date

Here

Signature

PO Box 182437

If a joint return,

Spouse’s

Columbus, Ohio 43218-2437

Date

both must sign.

Signature

Payment Enclosed:

RESET FORM

Paid

SSN/EIN

Make payable to: CITY TREASURER

Preparer’s

Date

Signature

Mail to:

Columbus Income Tax Division

Phone No.

(

)

Use Only

PO Box 182158

Rev. 10/21/10

Columbus, Ohio 43218-2158

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4