Instructions For Filing The Annual Report Of Unclaimed Property Safe Deposit Boxes And Safekeeping Items Using Form Upd205 And Upd206 - 2009 Page 3

ADVERTISEMENT

Section D - Complete this section if the business or company in Section B will no longer need to file annual unclaimed

property reports due to merger or change in file responsibility.

Merger: If the business listed in Section B has merged with another company that will be responsible for filing future

safe deposit box reports, provide the name, address and FEIN of the surviving business.

Change in Filing Responsibilities: If the business listed in Section B is a branch of another corporation and future

reports for this business will be filed by the parent corporation, provide the name, address and FEIN of the parent

corporation.

Section E -

Charter Date and FEIN:

Verify the charter date and FEIN (Federal Employers Identification Number) for

your institution. If inaccurate or missing, please list the corrected information.

Number of SD Boxes or Safekeeping Items to Report to State:

Report only the box numbers of the boxes that

have contents. The boxes listed on the back of the UPD205 must agree with the total number of boxes to remit in Section E

of UPD205 with the number of Drilling Statements (UPD206) attached. Do not report boxes listed on a previous report.

If reporting safekeeping items, report the number of owners here. The total safekeeping account or reference numbers

listed on the back of UPD205 must agree with the number of owners reported here.

Box or Safekeeping Number (the back of form UPD205):

List the box or safekeeping number of the items being

reported. If no number or name is associated with a safekeeping item, assign a reference number to it. Complete the

UPD206 form for each owner of a safe deposit box or safekeeping items.

Nothing to Report

:

According to Section 760.20 of the rules, if you have no abandoned safe deposit boxes as defined by

still required

statute or rule, you are

to file a report. Mark the appropriate box in Section E, sign the form and return it.

Section F

-

This report must be verified and signed in order to be considered complete and in compliance with

reporting requirements. Unsigned reports will be returned. The person signing the report should be the person responsible for

answering questions or resolving problems for the report, and for scheduling the remittance of box contents.

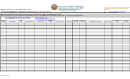

INSTRUCTIONS FOR COMPLETING FORM UPD206 - DRILLING STATEMENT

In this packet is one Drilling Statement form (UPD206), which may be duplicated as needed. This form is to be used for

reporting owners of abandoned safe deposit boxes or owners of abandoned safekeeping items. Safe deposit boxes with

. Do not report boxes with

leases that expired June 30, 2004 and prior are considered abandoned and reportable

lease expiration dates after June 30, 2004.

One form (UPD206) is to be completed for each box being reported or

Do

each owner of safekeeping items. Use this to report all pertinent information concerning owners and their property.

not report empty boxes.

Please refer to the following illustration and correspondingly numbered regions for assistance

in completing the owner record.

Unclaimed Property

Safe Deposit Box Drilling Statement

UPD 206

Holder Name

_______________________________

1

____

Page _____ of

Check

Rel Code

Prefix

Last Name or Company (40): (circle one)

First (30)

MI (10)

Suffix(10)

One

(10)

3

4

5

6

7

8

_____

Single

2

___

Bldg., Room, Floor, Suite or Apt # (30)

Joint Owner

9

___

___

of

Street or RR / Box (30)

10

PO Box / APO / Foreign (30)

Country

11

City (30)

State (2)

ZIP (9)

SSN

12

13

14

15

Comments

16

Region 1 - Holder Name:

Enter the name of the business from Section B of the barcoded form UPD205.

TIP: TYPE THE HOLDER NAME AND HOLDER NUMBER BEFORE DUPLICATING FORM UPD206.

Region 2 -

On form UPD206, there are two (2) complete owner information records. If the property being reported has

only one owner, you would complete one record for it. For property with two or more owners, complete an owner

record for each owner.

For each owner record, indicate whether the record is a single entity (check Single) or one of multiple owners. To

denote multiple owners, indicate on each owner record which record it is (e.g. owner 1 of 2 or owner 2 of 2). List

owner record 1 first, and additional owners immediately afterward, in numeric order.

-- 2 --

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5