Application For Certificate Of Authority

ADVERTISEMENT

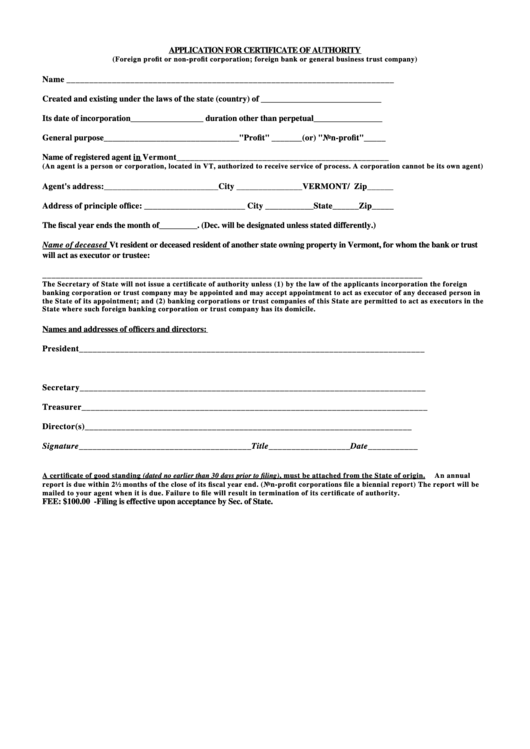

APPLICATION FOR CERTIFICATE OF AUTHORITY

(Foreign profit or non-profit corporation; foreign bank or general business trust company)

Name ________________________________________________________________________

Created and existing under the laws of the state (country) of ____________________________

Its date of incorporation_________________ duration other than perpetual________________

General purpose_______________________________"Profit" _______(or) "Non-profit"_____

Name of registered agent in Vermont_______________________________________________

(An agent is a person or corporation, located in VT, authorized to receive service of process. A corporation cannot be its own agent)

Agent's address:__________________________City _______________VERMONT/ Zip______

Address of principle office: _______________________ City ___________State______Zip_____

The fiscal year ends the month of_________. (Dec. will be designated unless stated differently.)

Name of deceased Vt resident or deceased resident of another state owning property in Vermont, for whom the bank or trust

will act as executor or trustee:

___________________________________________________________________________________

The Secretary of State will not issue a certificate of authority unless (1) by the law of the applicants incorporation the foreign

banking corporation or trust company may be appointed and may accept appointment to act as executor of any deceased person in

the State of its appointment; and (2) banking corporations or trust companies of this State are permitted to act as executors in the

State where such foreign banking corporation or trust company has its domicile.

Names and addresses of officers and directors:

President____________________________________________________________________________

V.President__________________________________________________________________________

Secretary____________________________________________________________________________

Treasurer____________________________________________________________________________

Director(s)________________________________________________________________________

Signature______________________________________Title__________________Date___________

A certificate of good standing (dated no earlier than 30 days prior to filing), must be attached from the State of origin.

An annual

report is due within 2½ months of the close of its fiscal year end. (Non-profit corporations file a biennial report) The report will be

mailed to your agent when it is due. Failure to file will result in termination of its certificate of authority.

FEE: $100.00 -Filing is effective upon acceptance by Sec. of State.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1