Reset Form

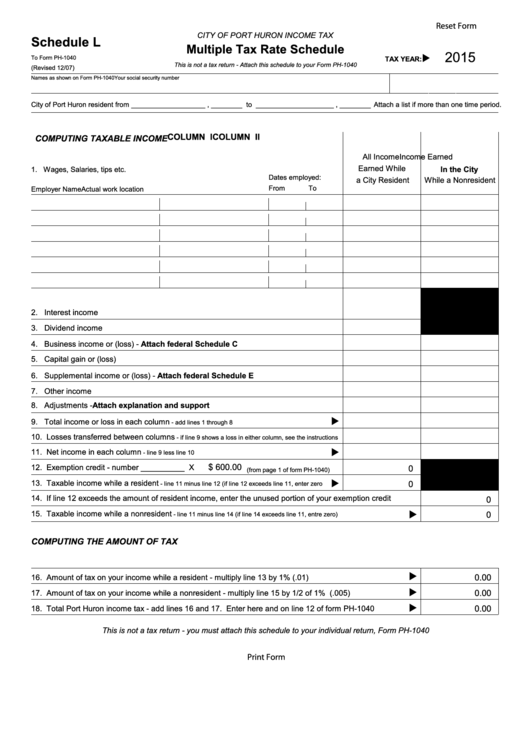

CITY OF PORT HURON INCOME TAX

Schedule L

Multiple Tax Rate Schedule

2015

u

To Form PH-1040

TAX YEAR:

This is not a tax return - Attach this schedule to your Form PH-1040

(Revised 12/07)

Names as shown on Form PH-1040

Your social security number

City of Port Huron resident from ___________________ , ________ to ____________________ , ________

Attach a list if more than one time period.

COLUMN I

COLUMN II

COMPUTING TAXABLE INCOME

All Income

Income Earned

Earned While

In the City

1. Wages, Salaries, tips etc.

Dates employed:

a City Resident

While a Nonresident

From

To

Employer Name

Actual work location

2. Interest income

3. Dividend income

4. Business income or (loss) - Attach federal Schedule C

5. Capital gain or (loss)

6. Supplemental income or (loss) - Attach federal Schedule E

7. Other income

8. Adjustments - Attach explanation and support

u

9. Total income or loss in each column

- add lines 1 through 8

10. Losses transferred between columns

- if line 9 shows a loss in either column, see the instructions

11. Net income in each column

u

- line 9 less line 10

$ 600.00

12. Exemption credit - number __________ X

0

(from page 1 of form PH-1040)

u

13. Taxable income while a resident

0

- line 11 minus line 12 (if line 12 exceeds line 11, enter zero

14. If line 12 exceeds the amount of resident income, enter the unused portion of your exemption credit

0

15. Taxable income while a nonresident

u

0

- line 11 minus line 14 (if line 14 exceeds line 11, entre zero)

COMPUTING THE AMOUNT OF TAX

u

16. Amount of tax on your income while a resident - multiply line 13 by 1% (.01)

0.00

u

0.00

17. Amount of tax on your income while a nonresident - multiply line 15 by 1/2 of 1% (.005)

u

0.00

18. Total Port Huron income tax - add lines 16 and 17. Enter here and on line 12 of form PH-1040

This is not a tax return - you must attach this schedule to your individual return, Form PH-1040

Print Form

1

1