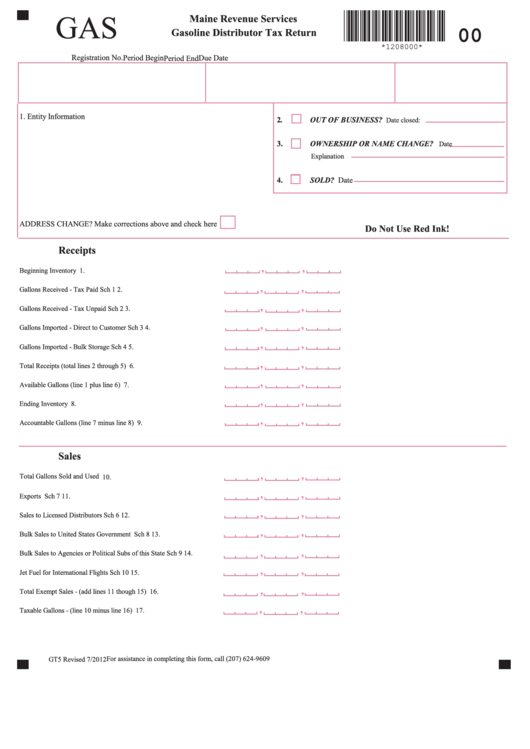

Form Gt-5 - Gasoline Distributor Tax Return 2012

ADVERTISEMENT

GAS

Maine Revenue Services

00

Gasoline Distributor Tax Return

*1208000*

Registration No.

Period Begin

Due Date

Period End

1. Entity Information

2.

OUT OF BUSINESS?

Date closed:

3.

OWNERSHIP OR NAME CHANGE?

Date

Explanation

4.

SOLD? Date

ADDRESS CHANGE? Make corrections above and check here

Do Not Use Red Ink!

Receipts

,

,

Beginning Inventory

1.

,

,

Gallons Received - Tax Paid

Sch 1

2.

,

,

Gallons Received - Tax Unpaid

Sch 2

3.

,

,

Gallons Imported - Direct to Customer

Sch 3

4.

,

,

Gallons Imported - Bulk Storage

Sch 4

5.

,

,

Total Receipts (total lines 2 through 5)

6.

,

,

Available Gallons (line 1 plus line 6)

7.

,

,

Ending Inventory

8.

,

,

Accountable Gallons (line 7 minus line 8)

9.

Sales

,

,

Total Gallons Sold and Used

10.

,

,

Exports

Sch 7

11.

,

,

Sales to Licensed Distributors

Sch 6

12.

,

,

Bulk Sales to United States Government

Sch 8

13.

,

,

Bulk Sales to Agencies or Political Subs of this State

Sch 9

14.

,

,

Jet Fuel for International Flights

Sch 10

15.

,

,

Total Exempt Sales - (add lines 11 though 15)

16.

,

,

Taxable Gallons - (line 10 minus line 16)

17.

For assistance in completing this form, call (207) 624-9609

GT5 Revised 7/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2